Loading

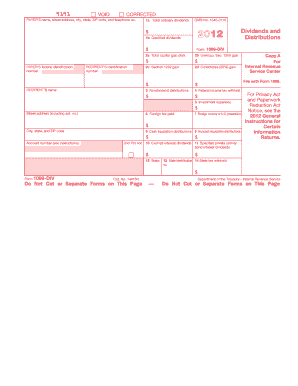

Get Irs 1099-div 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-DIV online

Filling out the IRS 1099-DIV form online can be a straightforward process with the right guidance. This comprehensive guide will provide you with step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete the IRS 1099-DIV form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the payer’s name, street address, city, state, ZIP code, and telephone number in the designated fields.

- Fill in the recipient’s name, identification number, and address. Ensure that the recipient’s details are accurate and match their legal identification.

- In box 1a, report the total ordinary dividends received by the recipient during the year.

- Complete box 1b with the amount of qualified dividends that are potentially eligible for special tax rates.

- In box 2a, enter the total capital gain distributions the recipient received.

- Fill in boxes 2b, 2c, and 2d for specific types of capital gains, ensuring that you include any pertinent amounts.

- In box 3, report any nondividend distributions, which represent a return of the recipient’s capital.

- Complete box 4 if federal income tax was withheld, providing the total withheld amount.

- If applicable, enter any investment expenses in box 5.

- Complete box 6 with any foreign taxes paid that the recipient may be able to claim as a credit.

- Fill in boxes 7 through 14 as needed, ensuring that you report pertinent information regarding cash and noncash liquidation distributions, exempt-interest dividends, and state taxes withheld.

- Review all filled sections for accuracy before proceeding.

- Save your changes, and choose to download, print, or share the completed form as required.

Complete your IRS 1099-DIV form online today for a smooth tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Your IRS 1099-DIV is sent by financial institutions where you have investment accounts, such as banks or brokerage firms. They send this form to report dividends and capital gains you earned during the tax year. If you have multiple accounts, each institution should provide you with a separate form. If you need help understanding your tax documents, platforms like US Legal Forms can offer valuable resources.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.