Loading

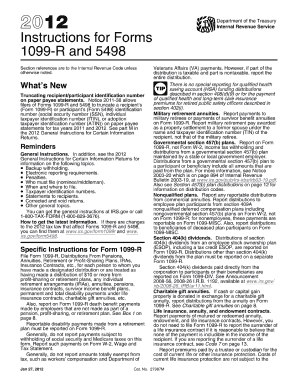

Get Irs Instruction 1099-r & 5498 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1099-R & 5498 online

This guide provides clear and supportive instructions on how to fill out the IRS Instruction 1099-R and 5498 forms online. Whether you are new to tax forms or have some experience, this step-by-step guide will help you navigate the process with confidence.

Follow the steps to easily complete your IRS forms online.

- Press the ‘Get Form’ button to access the necessary forms and open them in your preferred digital editor.

- Begin with Form 1099-R. Enter the gross distribution amount in Box 1, which should reflect the total distributed before any deductions.

- In Box 2a, indicate the taxable amount of the distribution. If you cannot determine the taxable amount, leave this box blank and check the 'Taxable amount not determined' box in Box 2b.

- For distributions related to contributions, input any amounts in Box 5 that may be recoverable tax-free by the employee.

- Fill out Box 7 with appropriate distribution codes based on the type of distribution, as outlined in the instructions.

- Proceed to Form 5498. Report contributions made in Box 1, and if applicable, include rollover contributions in Box 2.

- For any Roth IRA conversions, detail the amount in Box 3. If relevant, indicate any recharacterized contributions in Box 4.

- Ensure to fill out the FMV of the account in Box 5 and verify any codes in Box 15a and 15b for hard-to-value assets.

- Finally, review all entries for accuracy. Users can save changes, download, print, or share the completed form as needed.

Complete your IRS forms online confidently and ensure timely submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, a 1099-R affects your tax return by adding to your taxable income. This form shows distributions from retirement accounts, which impact your overall tax liability. Understanding the IRS Instruction 1099-R & 5498 is essential for managing potential tax consequences effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.