Loading

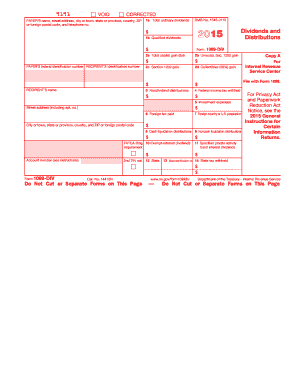

Get Irs 1099-div 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-DIV online

The IRS 1099-DIV form is essential for reporting dividends and distributions received from investments. This guide provides clear, step-by-step instructions on how to accurately complete the form online to ensure compliance and avoid potential penalties.

Follow the steps to fill out the IRS 1099-DIV online with ease.

- Click ‘Get Form’ button to access the IRS 1099-DIV and open it in your editor.

- Enter the payer's name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone number in the designated fields.

- Fill in the payer's federal identification number and the recipient's identification number accurately.

- In Box 1a, report the total ordinary dividends received. This amount must be included in your taxable income.

- In Box 1b, enter the portion of ordinary dividends that may qualify for reduced capital gains rates.

- In Box 2a, report the total capital gain distributions received from supported investment companies or real estate investment trusts.

- Complete sections for unrecaptured Section 1250 gain (Box 2b), Section 1202 gain (Box 2c), and collectibles gain (Box 2d) if applicable.

- Report any nondividend distributions in Box 3 and federal income tax withheld in Box 4.

- Fill out investment expenses in Box 5 and any foreign taxes paid in Box 6.

- In Boxes 8 and 9, provide details for cash and noncash liquidation distributions respectively.

- Complete Boxes 10 through 14 with exempt-interest dividends, state information, and state tax withheld where applicable.

- Once all fields are filled out, save your changes, then download or print the form for your records.

Start filling out your IRS 1099-DIV online today to keep your financial reporting in check.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

There is no minimum amount for reporting IRS 1099-DIV income. You must report all dividends regardless of how small they may be. Reporting ensures compliance with IRS regulations and helps maintain accurate financial records. Uslegalforms can assist you in determining the best way to report these amounts.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.