Loading

Get Irs Instruction 1099-misc 2013

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1099-MISC online

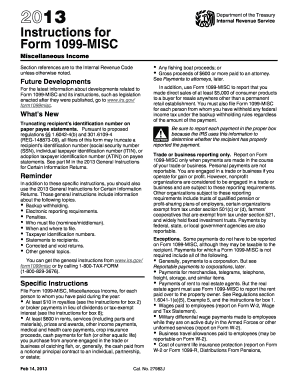

Filling out the IRS Form 1099-MISC online can seem daunting, but with guidance, it is manageable. This guide will help you understand the components of the form and provide clear, step-by-step instructions for completion.

Follow the steps to fill out the form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the payer’s name, address, and identification number. Ensure that the information is accurate and matches your records.

- Input the recipient's name, address, and identification number. Use the correct format for social security numbers or employer identification numbers.

- In box 1, enter the total rent payments amounting to $600 or more made during the year.

- Report any royalty payments in box 2. Include amounts of $10 or more received by the recipient.

- For other income types that do not fit in boxes 1 or 2, report them in box 3. This should include $600 or more.

- Document any nonemployee compensation of $600 or more in box 7. Include payments made to independent contractors.

- If applicable, indicate federal income tax withheld in box 4.

- Complete any additional relevant boxes based on your transactions, including fishing boat proceeds, medical payments, or crop insurance.

- Review the form for accuracy. Once complete, save your changes, and download or print the form for filing.

Complete your documents online and ensure timely submissions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You should enter the income from a 1099 on the appropriate line of your tax return, typically on Schedule C if you're self-employed. Refer to the IRS Instruction 1099-MISC for specifics on where to report this income. Platforms like uslegalforms can help clarify the process for you.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.