Loading

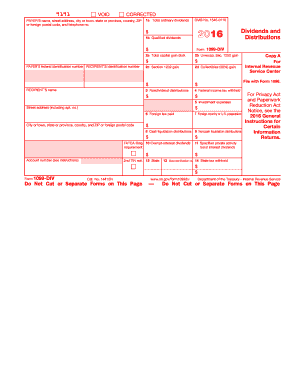

Get Irs 1099-div 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-DIV online

Filling out the IRS 1099-DIV form online can seem daunting, but with clear guidance, the process can be straightforward. This guide will walk you through each section of the form to ensure accurate completion.

Follow the steps to fill out the IRS 1099-DIV form accurately.

- Click the ‘Get Form’ button to access the IRS 1099-DIV form and open it in your preferred online editor.

- Begin by entering the payer’s name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone number in the designated fields.

- Fill in the payer’s federal identification number and the recipient’s identification number. Ensure accuracy to avoid issues with the IRS.

- Proceed to section 1a labeled 'Total ordinary dividends' and input the total amount of ordinary dividends received. If applicable, enter qualified dividends in box 1b.

- In section 2, report total capital gain distributions in box 2a. If relevant, also complete boxes 2b for unrecaptured section 1250 gain, 2c for section 1202 gain, and 2d for collectibles (28%) gain.

- In box 3, indicate the non-dividend distributions. This amount should reflect any return of investment you received.

- If federal income tax was withheld, enter that amount in box 4. This may apply if backup withholding is necessary.

- Complete box 5 by listing any investment expenses associated with the dividends. Note that you may need to provide additional documentation if required.

- Fill in box 6 with the foreign tax paid, if applicable. This will help determine any potential tax credits or deductions you may qualify for.

- As you complete the form, verify all information for accuracy. After finishing, you can save the changes, download the completed form, or print it as needed.

Start completing your IRS 1099-DIV form online today to ensure all your dividend income is reported accurately.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

While it is technically possible to file your taxes without your IRS 1099-DIV, you should not do so. Missing this form may lead to inaccurate reporting of your income, which can result in penalties. If you cannot locate your 1099-DIV, we recommend using our platform at US Legal Forms for guidance on how to proceed.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.