Loading

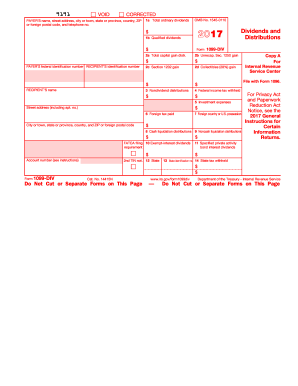

Get Irs 1099-div 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-DIV online

Filling out the IRS 1099-DIV form online is essential for reporting dividends and distributions. This guide provides clear, step-by-step instructions, ensuring that users can complete the form accurately and efficiently.

Follow the steps to fill out the IRS 1099-DIV online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the payer’s information, including the name, street address, city or town, state or province, country, ZIP code, and telephone number in the designated fields.

- Provide the federal identification number of the payer and the recipient's identification number. Ensure accuracy to avoid issues with the IRS.

- Fill in Box 1a with the total ordinary dividends you have received during the year. This amount is taxable.

- Complete Box 1b with the amount of qualified dividends from Box 1a that may be eligible for reduced capital gains rates.

- In Box 2a, report the total capital gain distributions received from regulated investment companies or real estate investment trusts.

- If applicable, fill out Box 4 for federal income tax withheld. This amount should be included in your income tax return.

- Complete Boxes 5 through 11 as necessary, noting any investment expenses, foreign taxes paid, and additional distribution types.

- Carefully review all entries for accuracy and completeness to ensure compliance with IRS requirements.

- Once all information is accurately entered, save the changes to your form. You may download, print, or share the completed form as needed.

Start filling out your IRS 1099-DIV form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain your IRS 1099-DIV, you usually need to wait until tax season when financial institutions issue this document. You can get it either via mail or electronically by logging into your financial account. If you face challenges during this process, US Legal Forms offers resources to help simplify tax document retrieval.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.