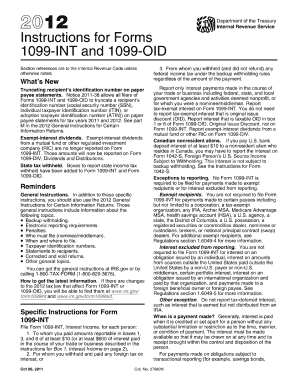

Get Irs Instruction 1099-int & 1099-oid 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS Instruction 1099-INT & 1099-OID online

Filling out the IRS Instruction 1099-INT & 1099-OID online can be a straightforward process with the right guidance. This guide provides a comprehensive overview and step-by-step instructions to help you accurately complete these forms while navigating any complexities.

Follow the steps to effectively complete your 1099-INT & 1099-OID forms online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred digital editor.

- Review the top of the form for the payer's information. Enter the payer's name, address, and taxpayer identification number (TIN) accurately to ensure proper identification.

- Proceed to the recipient's section. Input the recipient's name, address, and TIN. Confirm that all details match the recipient's official documents to avoid discrepancies.

- In the income section, fill in the applicable fields. For the 1099-INT, report the total interest income paid to the recipient. For the 1099-OID, record the original issue discount amount as necessary.

- If applicable, complete additional fields related to federal backup withholding. Include any amount withheld from the recipient's payments, if relevant to their situation.

- Carefully review all information entered for accuracy. It is crucial to check for any typos or errors that could lead to issues with the IRS.

- Once satisfied with the form, you may save changes, download a copy for your records, print the form if needed, or share it with the relevant parties.

Complete your IRS forms online today and ensure a smooth filing process.

Get form

Related links form

Yes, there is a significant difference between a 1099 and a 1099-INT. A 1099 form is a broad category used to report various types of income other than wages, salaries, and tips, while a 1099-INT specifically reports interest income. The 1099-INT details interest accrued on savings, loans, or investment accounts. Understanding these distinctions is essential for accurate tax filing under IRS Instruction 1099-INT & 1099-OID.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.