Loading

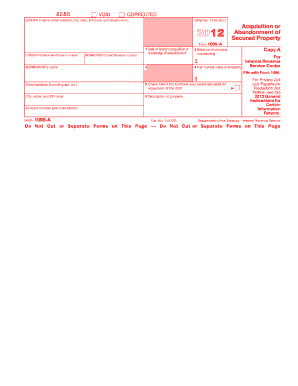

Get Irs 1099-a 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-A online

Filling out the IRS Form 1099-A is essential for reporting the acquisition or abandonment of secured property. This guide will provide you with clear, step-by-step instructions to complete the form accurately and confidently, even if you have limited legal experience.

Follow the steps to complete the IRS 1099-A online.

- Click ‘Get Form’ button to obtain the form and open it in an editor.

- Enter the lender's name, street address, city, state, ZIP code, and telephone number in the designated fields.

- Provide the lender's federal identification number, ensuring that all numbers are accurate.

- Fill in the borrower's name, street address (including apartment number), city, state, ZIP code, and identification number.

- In Box 1, enter the date of the lender's acquisition of the property or the date they first knew it was abandoned.

- In Box 2, indicate the balance of principal outstanding at the time of acquisition or when abandonment was recognized.

- In Box 4, record the fair market value of the property at the time of acquisition or abandonment.

- Check Box 5 if the borrower was personally liable for repayment of the debt; leave it unchecked if not.

- In Box 6, provide a description of the property acquired or abandoned.

- Review all entered information for accuracy and completeness.

- Finally, save your changes, and choose to download, print, or share the form as needed.

Start filling out the IRS 1099-A online today to ensure accurate reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To file IRS 1099s on your taxes, you will typically report the income shown on the form using Form 1040 and any necessary supporting schedules. Make sure to gather all your 1099 forms before beginning your tax return, as accurate reporting is essential to stay compliant. If you are unsure about the filing process, US Legal Forms offers comprehensive guides to streamline your tax filing.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.