Loading

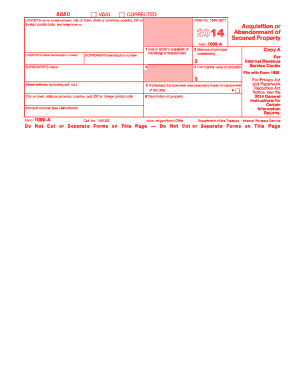

Get Irs 1099-a 2014

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-A online

Filling out the IRS 1099-A form is essential for reporting the acquisition or abandonment of secured property. This guide provides a clear and comprehensive approach to completing the form online, ensuring you meet your reporting requirements accurately.

Follow the steps to complete the IRS 1099-A online.

- Click ‘Get Form’ button to obtain the IRS 1099-A form and open it in your preferred online editor.

- Enter the lender's name and address in the appropriate fields, ensuring all details are accurate.

- Input the lender's federal identification number for accurate identification.

- Fill in the borrower's identification number, providing the last four digits for privacy protection.

- Indicate the date of the lender's acquisition or knowledge of abandonment in Box 1.

- In Box 2, specify the balance of the principal outstanding at the time of acquisition or abandonment.

- Complete Box 4 with the fair market value of the property at the time of the lender's acquisition.

- If applicable, check Box 5 to indicate whether the borrower was personally liable for repayment of the debt.

- Describe the property in Box 6, providing sufficient details for identification.

- Review the form for accuracy and completeness before finalizing your entry.

- Once completed, save your changes, and you can download, print, or share the form as needed.

Complete your IRS 1099-A form online today to ensure timely and accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The IRS 1099-A itself is not a tax return; rather, it is a reporting form related to specific financial events. You may use the information on the form to help prepare your tax return accurately. Understanding how the IRS 1099-A fits into your overall tax picture can simplify your filing process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.