Loading

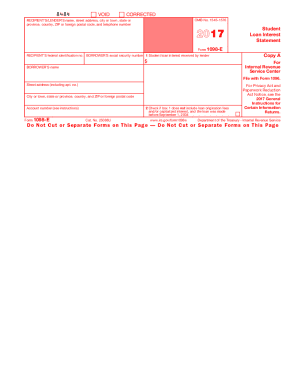

Get Irs 1098-e 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1098-E online

Filling out the IRS 1098-E form online is essential for reporting student loan interest for tax purposes. This guide will provide you with a clear and structured approach to accurately complete this form.

Follow the steps to effectively fill out the IRS 1098-E online.

- Click ‘Get Form’ button to access the form and open it for editing.

- In the first section, enter the recipient’s/lender’s name, address, and telephone number. Make sure the information is accurate as it is vital for identification purposes.

- Next, provide the recipient’s federal identification number and the borrower’s social security number. This information is important for the IRS to correctly process the form.

- In Box 1, report the total amount of student loan interest received by the lender during the year. This figure must reflect the accurate sum for a complete deduction process.

- If applicable, check the box indicating that Box 1 does not include loan origination fees or capitalized interest for loans made before September 1, 2004. This is essential for those claiming deductions correctly.

- Fill in the account number if provided by the lender. This detail helps distinguish your loan account from others.

- After reviewing the completed form for accuracy, you can save your changes, download the form for your records, print it, or share it as necessary.

Start filling out your IRS 1098-E online today to ensure accurate reporting and potential tax benefits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can often look up your IRS 1098-T online through your educational institution's student portal. Most schools provide easy access to financial forms, including tax documents. If you face difficulties, consider reaching out to your school's financial office for further assistance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.