Get Irs 990 - Schedule B 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule B online

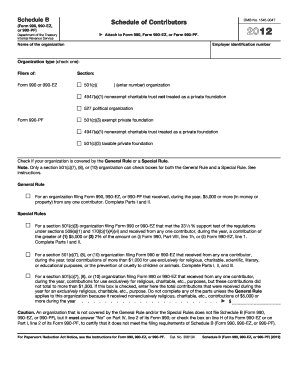

Filing the IRS 990 - Schedule B is an essential requirement for certain tax-exempt organizations to report contributions received throughout the year. This guide aims to provide clear and supportive step-by-step instructions for filling out the form correctly online, ensuring compliance with IRS regulations.

Follow the steps to complete the IRS 990 - Schedule B easily.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- In the first section, enter the name of your organization and its employer identification number (EIN). Select the type of organization by checking the appropriate box to indicate if it files Form 990, 990-EZ, or 990-PF.

- Indicate if your organization is covered under the General Rule or a Special Rule. If your organization received $5,000 or more from any contributor during the year, check the General Rule box and proceed to complete Parts I and II.

- For Special Rules applicable to certain section 501(c)(3) organizations, ensure that you meet the specified criteria before listing only certain contributors in Parts I and II.

- In Part I, number each contributor sequentially. For each entry, provide the contributor's name, address, and total contributions received during the tax year. Also, specify the type of contribution: cash, payroll, or noncash.

- If any noncash contributions were received, complete Part II by describing the noncash property, noting its fair market value, and the date received.

- If applicable, complete Part III to provide details about exclusively religious, charitable, or educational contributions, including any related purpose and descriptions related to the transfer or holding of gifts.

- Review all entries for accuracy, save the changes, and then download or print the completed form for your records or to share.

Start completing your IRS 990 - Schedule B online today to ensure compliance and accurate reporting of contributions.

Get form

Pledges are not recognized as income until they are formally committed and there is reasonable assurance of collection. Nonprofits must carefully evaluate their pledges, ensuring that they meet accounting standards for revenue recognition. Including pledges in the income statement before they are collectable could mislead financial reporting. Understand the nuances of IRS 990 - Schedule B to ensure proper income recognition.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.