Get Irs Instruction 1040 - Schedule E 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1040 - Schedule E online

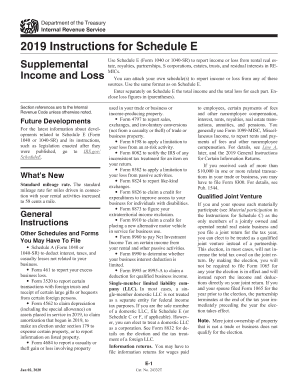

Filling out IRS Instruction 1040 - Schedule E can seem daunting, but with careful guidance, you can navigate it with ease. This form is essential for reporting income or loss from rental real estate, royalties, and various other sources. Here, you will find clear, step-by-step instructions to successfully complete this form online.

Follow the steps to fill out the form accurately and efficiently.

- Click ‘Get Form’ button to access the Schedule E form and open it in your preferred editor.

- Begin by reading the general guidelines provided on the form carefully, as they inform you on how to accurately report your rental incomes and losses.

- For each property listed, complete relevant fields regarding the number of days rented and personal use days. This is crucial for understanding deductions.

- If you have associated expenses, fill them in Part I and II as required. Make sure to categorize them correctly based on the type of expense.

- Once all pertinent sections are completed, review your entries for accuracy and completeness, ensuring that all totals are calculated correctly.

Start filling out your IRS Instruction 1040 - Schedule E online today to ensure timely and accurate submission!

Get form

Self-employment tax does not reduce your taxable income directly, but it affects your overall tax liability. Understanding the implications of self-employment income within the framework of IRS Instruction 1040 - Schedule E is crucial for tax planning. While self-employment taxes contribute to Social Security and Medicare, they also require careful accounting. Consulting tax resources can help you navigate these complexities effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.