Loading

Get Ssn 2018

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Publ 503 online

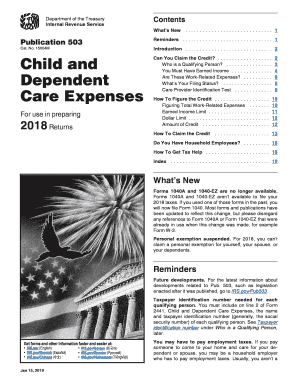

Filling out the IRS Publ 503 is an essential step for taxpayers seeking to claim the child and dependent care credit. This guide will walk you through the components of the form and provide clear instructions for completing it online.

Follow the steps to complete the IRS Publ 503 accurately.

- Click ‘Get Form’ button to obtain the IRS Publ 503 form and open it in your preferred editor.

- Begin by providing your name, address, and filing status as applicable. Ensure that the information is accurate to avoid any processing delays.

- Next, identify any qualifying persons for whom you paid care expenses. You will need to list their names and taxpayer identification numbers.

- Detail your earned income if applicable. It's imperative that the income matches the requirements outlined in the form.

- Input the total work-related expenses you paid for the care of qualifying persons. Ensure that all entries are accurate and within the specified limits.

- Complete the section identifying your care providers, including their names, addresses, and taxpayer identification numbers.

- Review your entries for any inaccuracies or missing information. Ensure all required fields are completed.

- Once you have filled in all sections, save all changes to the form, and decide if you want to download, print, or share the completed form.

Get started on your IRS Publ 503 online form today to ensure you claim your eligible child and dependent care credits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To claim the $8,000 Child Tax Credit, you need to ensure that you meet the eligibility requirements set by the IRS. You must also complete the appropriate tax forms during the filing process. Using tax preparation software or consulting a tax professional can simplify this process. Don't forget, checking IRS Publ 503 can provide additional clarity on the rules surrounding tax credits.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.