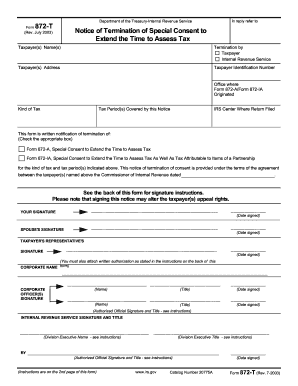

Get Irs 872-t 2003-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 872-T online

How to fill out and sign IRS 872-T online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

US Legal Forms is the leading publisher of professionally crafted documents and samples.

Acquire an authentic form easily.

If you don’t find the IRS 872-T you are looking for, please submit a draft request. We’ve made US Legal Forms accessible for everyone. Our professionals create samples with clear instructions to ensure their accuracy, relevance, and legality. We assist millions of individuals in saving time and money on legal expenses.

- Just search your IRS 872-T online with our reliable and comprehensive catalog featuring state-specific documents and templates.

- Refer to the straightforward step-by-step instructions to get your IRS 872-T promptly:

- Utilize the website’s search tool or browse templates by category.

- Select your state from the list and input your search term. This is essential as many states demand unique formats according to their laws and regulations.

- Choose the document you need from the search results to view more information and a free preview.

- Examine the IRS 872-T preview. If available, ensure to obtain the necessary blank.

- Review additional information about the content provided and check out any related electronic downloads. You may need supplementary documentation to accompany your existing record.

- Add the item to your cart. You can immediately purchase the download or request a physical copy to your mailing address.

- Proceed to checkout or continue shopping.

How to Alter Get IRS 872-T 2003: Personalize Forms Online

Completing documents is straightforward with intelligent online tools. Eliminate paperwork with easily accessible Get IRS 872-T 2003 templates you can adapt online and print.

Creating documents must be more convenient, whether it's a routine aspect of one’s job or infrequent tasks. When someone needs to submit a Get IRS 872-T 2003, reviewing rules and instructions on how to accurately fill out a form and what it must contain can require significant time and effort. However, if you find the appropriate Get IRS 872-T 2003 template, finishing a document will no longer be a hurdle with a smart editor available.

Uncover a broader array of features you can incorporate into your document processing routine. No need to physically print, complete, and annotate forms. With an intelligent editing platform, all vital document processing functions are perpetually accessible. If you seek to enhance your workflow with Get IRS 872-T 2003 forms, locate the template in the catalog, click on it, and find an easier way to complete it.

It's also feasible to introduce custom graphic elements into the form. Utilize the Arrow, Line, and Draw tools to modify the document. The more tools you are acquainted with, the easier it gets to work with Get IRS 872-T 2003. Experience the solution that offers everything necessary to discover and alter forms in a single browser tab and move past manual paperwork.

- If you want to insert text at a specific section of the form or add a text field, utilize the Text and Text Field tools to expand the text in the form as needed.

- Take advantage of the Highlight tool to emphasize the essential elements of the form.

- If you wish to obscure or eliminate certain text portions, use the Blackout or Erase tools.

- Personalize the form by integrating default graphic components into it. Employ the Circle, Check, and Cross tools to incorporate these elements into the forms, if applicable.

- For further annotations, make use of the Sticky Note feature to add as many notes as necessary to the forms page.

- Should the form require your initials or date, the editor has tools for that as well. Reduce the risk of mistakes by using the Initials and Date options.

Related links form

Typically, the IRS can go back three years to audit your returns, but this period can extend to six years if they suspect significant underreporting of income. In cases of fraud, there’s no time limit on audits. If you find yourself facing a potential audit, reviewing IRS 872-T guidelines may provide helpful insights into your rights and responsibilities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.