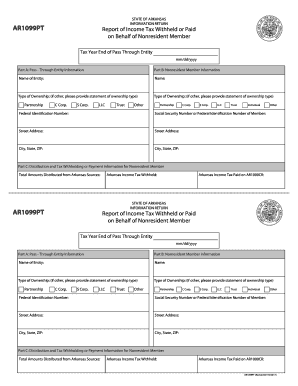

Get AR AR1099PT 2017-2024

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Arkansas withholding form online

How to fill out and sign Arkansas tax brackets online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax season began unexpectedly or maybe you just misssed it, it would probably cause problems for you. AR AR1099PT is not the easiest one, but you do not have reason for worry in any case.

Utilizing our professional solution you will see how you can complete AR AR1099PT even in situations of critical time deficit. You just need to follow these simple guidelines:

-

Open the file in our powerful PDF editor.

-

Fill in all the information required in AR AR1099PT, utilizing fillable lines.

-

Include photos, crosses, check and text boxes, if you want.

-

Repeating info will be filled automatically after the first input.

-

In case of misunderstandings, turn on the Wizard Tool. You will receive useful tips for much easier submitting.

-

Do not forget to include the date of application.

-

Create your unique signature once and place it in all the needed lines.

-

Check the information you have included. Correct mistakes if necessary.

-

Click on Done to finalize modifying and choose the way you will send it. You have the opportunity to use digital fax, USPS or e-mail.

-

You are able to download the document to print it later or upload it to cloud storage like Google Drive, OneDrive, etc.

With our powerful digital solution and its beneficial instruments, submitting AR AR1099PT becomes more convenient. Do not hesitate to try it and spend more time on hobbies and interests rather than on preparing paperwork.

How to edit Arkansas state withholding tax: customize forms online

Put the right document management tools at your fingertips. Complete Arkansas state withholding tax with our trusted service that comes with editing and eSignature functionality}.

If you want to execute and sign Arkansas state withholding tax online without hassle, then our online cloud-based option is the ideal solution. We provide a rich template-based library of ready-to-use forms you can edit and complete online. In addition, you don't need to print out the form or use third-party solutions to make it fillable. All the necessary tools will be readily available for your use once you open the file in the editor.

Let’s go through our online editing tools and their key features. The editor has a intuitive interface, so it won't require a lot of time to learn how to use it. We’ll take a look at three main sections that allow you to:

- Modify and annotate the template

- Arrange your documents

- Make them shareable

The top toolbar has the tools that help you highlight and blackout text, without images and image components (lines, arrows and checkmarks etc.), add your signature to, initialize, date the form, and more.

Use the toolbar on the left if you would like to re-order the form or/and delete pages.

If you want to make the template fillable for others and share it, you can use the tools on the right and insert different fillable fields, signature and date, text box, etc.).

Aside from the functionality mentioned above, you can shield your file with a password, put a watermark, convert the document to the required format, and much more.

Our editor makes completing and certifying the Arkansas state withholding tax a breeze. It enables you to make basically everything concerning dealing with forms. Moreover, we always make sure that your experience modifying documents is safe and compliant with the major regulatory standards. All these factors make using our tool even more enjoyable.

Get Arkansas state withholding tax, apply the necessary edits and changes, and download it in the desired file format. Give it a try today!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing 2021 ar1000f

Optimize the time-consuming document preparation processes by following simple tips in this video guide. Get and fill out your ar1099pt instructions online. Make it quick, easy, and accurate.

Arkansas ar1099pt FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to arkansas state income tax

- w2 form

- arkansas withholding tax form

- does arkansas have state taxes

- form ar 3q tex

- form ar tx 2019

- form ar3mar

- form ar941pt

- how long does it take to get unemployment in arkansas

- income document

- mississippi 72 010

- scdor 111

- scdor 111 instructions

- taxes arkansas

- ar3mar form

- ar 3q tex

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.