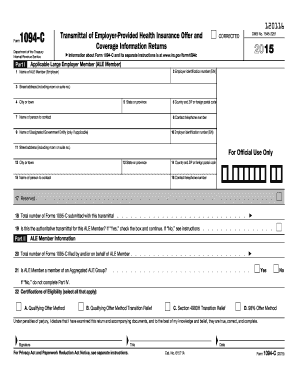

Get Irs 1094-c 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1094-C online

Filling out the IRS 1094-C can seem challenging, but this guide will walk you through each step to ensure your form is completed accurately. This form is essential for reporting employer-provided health insurance information, and understanding its components is crucial for compliance.

Follow the steps to complete the IRS 1094-C online

- Click 'Get Form' button to access the IRS 1094-C for online completion.

- In Part I, provide the information about the Applicable Large Employer (ALE) Member, including the name, Employer Identification Number (EIN), and contact details.

- Indicate the total number of Forms 1095-C submitted with this transmittal in the designated field.

- Specify if this transmittal is the authoritative one for this ALE Member by checking the appropriate box.

- Complete Part II by indicating whether the ALE Member is part of an Aggregated ALE Group and selecting the applicable certifications of eligibility.

- In Part III, fill in the monthly employee counts and health coverage offer indicators for each month of the year.

- If applicable, complete Part IV by entering the names and EINs of other ALE members in the Aggregated ALE Group.

- Review all entries for accuracy and completeness before finalizing.

- Save your changes, and choose to download, print, or share the form as needed.

Complete your IRS 1094-C online today to ensure compliance and avoid penalties.

Get form

Related links form

The employer, specifically the designated individual responsible for compliance, typically fills out the 1094-C. This individual should ensure that all relevant information about the employer and employee health coverage is accurately reported. Effective completion of the 1094-C requires careful attention to detail to comply with IRS regulations. USLegalForms can provide guidance and resources to make this task easier.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.