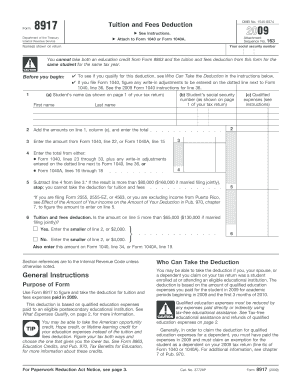

Get IRS 8917 2009

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Noncredit online

How to fill out and sign Qtp online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If people aren?t associated with document managing and legal processes, filling out IRS docs can be susprisingly tiring. We fully grasp the necessity of correctly finalizing documents. Our online software proposes the utility to make the procedure of completing IRS docs as elementary as possible. Follow these tips to properly and quickly complete IRS 8917.

The way to submit the IRS 8917 on the Internet:

-

Select the button Get Form to open it and start modifying.

-

Fill all necessary lines in the selected document utilizing our powerful and convenient PDF editor. Turn the Wizard Tool on to complete the process even simpler.

-

Make sure about the correctness of filled info.

-

Include the date of completing IRS 8917. Use the Sign Tool to create a special signature for the record legalization.

-

Finish modifying by clicking on Done.

-

Send this document straight to the IRS in the most convenient way for you: via electronic mail, with virtual fax or postal service.

-

You can print it on paper if a hard copy is needed and download or save it to the favored cloud storage.

Making use of our powerful solution will make expert filling IRS 8917 a reality. make everything for your comfortable and easy work.

How to edit Refigured: customize forms online

Benefit from the functionality of the multi-featured online editor while filling out your Refigured. Use the variety of tools to quickly fill out the blanks and provide the requested information in no time.

Preparing documents is time-consuming and costly unless you have ready-made fillable templates and complete them electronically. The simplest way to cope with the Refigured is to use our professional and multi-featured online editing solutions. We provide you with all the important tools for fast form fill-out and enable you to make any adjustments to your forms, adapting them to any requirements. Aside from that, you can comment on the changes and leave notes for other people involved.

Here’s what you can do with your Refigured in our editor:

- Fill out the blank fields using Text, Cross, Check, Initials, Date, and Sign options.

- Highlight essential details with a preferred color or underline them.

- Conceal sensitive data with the Blackout tool or simply erase them.

- Add pictures to visualize your Refigured.

- Substitute the original text with the one suiting your requirements.

- Add comments or sticky notes to communicate with others on the updates.

- Create additional fillable areas and assign them to exact recipients.

- Protect the template with watermarks, place dates, and bates numbers.

- Share the document in various ways and save it on your device or the cloud in different formats after you finish adjusting.

Working with Refigured in our robust online editor is the fastest and most effective way to manage, submit, and share your documentation the way you need it from anywhere. The tool operates from the cloud so that you can utilize it from any place on any internet-connected device. All forms you generate or fill out are safely stored in the cloud, so you can always access them whenever needed and be assured of not losing them. Stop wasting time on manual document completion and get rid of papers; make it all online with minimum effort.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing nonacademic

Experience the best way to prepare your FSA online in a matter of minutes by following our step-by-step instructions. Use easy-to-submit templates made by professionals for everyday people.

Coverdell FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to IRS 8917

- nonresident

- OMB

- 1098-T

- Distributions

- nonacademic

- FSA

- Coverdell

- Rico

- noncredit

- ESA

- refigure

- qtp

- refigured

- 37728P

- 2555-EZ

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.