Get Tx Comptroller Ap-114 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller AP-114 online

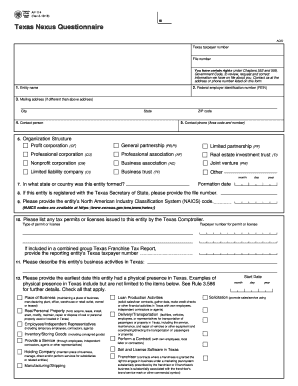

The TX Comptroller AP-114, known as the Texas Nexus Questionnaire, is a crucial document for entities operating in Texas to determine their franchise tax obligations. This guide provides step-by-step instructions to help users successfully complete the form online, ensuring all necessary information is accurately provided.

Follow the steps to complete the TX Comptroller AP-114 online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the entity name in the designated field. This should be the official name of your entity as registered.

- Provide the federal employer identification number (FEIN) in the appropriate section. This number is essential for tax identification.

- If your mailing address differs from the primary address, fill in the mailing address details, including city, state, and ZIP code.

- Identify a contact person for the entity and include their contact phone number with the area code.

- Select the correct organization structure from the options, such as profit corporation, limited partnership, or nonprofit corporation.

- Indicate the state or country where the entity was formed by selecting the appropriate option.

- If the entity is registered with the Texas Secretary of State, input the file number in the provided field.

- Provide the entity's North American Industry Classification System (NAICS) code to categorize your business activities.

- List any tax permits or licenses issued to the entity by the Texas Comptroller, including the taxpayer number for each permit.

- Describe the business activities the entity conducts in Texas in detail, ensuring clarity on what operations are managed.

- Document the earliest date the entity had a physical presence in Texas, checking all applicable options to describe this presence.

- If gross receipts from business done in Texas exceeded $500,000, provide the start date of the relevant federal income tax accounting period.

- If applicable, explain why nexus ended and include the last date of activity in Texas.

- Provide details for all members and general partners of the entity, ensuring to list their names, addresses, their FEINs, and percentage of ownership.

- Finally, sign the document by printing the preparer's name, title, phone number, and date, confirming the information is accurate.

Complete your TX Comptroller AP-114 online today to ensure compliance and streamline your business operations.

Get form

For tax payments in Texas, checks should be made out to the Texas Comptroller. Including essential information, such as your taxpayer ID or account number, can help with processing. For further details on handling your taxes, the TX Comptroller AP-114 serves as an excellent reference to clarify any specific instructions.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.