Loading

Get Nz Ir102 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NZ IR102 online

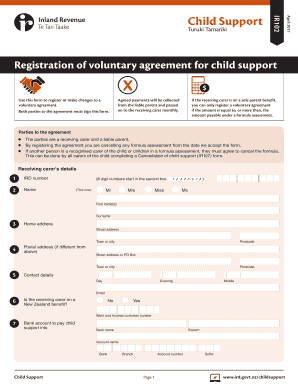

The NZ IR102 form is essential for registering or making changes to a voluntary agreement for child support. This guide walks you through each section of the form to ensure a smooth online filing process.

Follow the steps to successfully complete the NZ IR102 online.

- Click the ‘Get Form’ button to access the NZ IR102 form online and open it for completion.

- Begin with the receiving carer's details. Enter the IRD number, name, home address, postal address (if different), and contact details including phone numbers and email. Make sure to specify if the receiving carer is on a New Zealand benefit by checking the appropriate box.

- Provide the bank account information where child support payments will be deposited. This includes entering the bank name, branch, account name, and account number.

- Next, fill in the liable parent's details in the same manner as the receiving carer. Ensure that all information is accurate including the IRD number, name, addresses, and contact details.

- For each child involved in the agreement, enter the required information including their first name, surname, date of birth, IRD number (if applicable), and the agreed payment amount. You can indicate the frequency of payments (weekly or monthly). If there are more than three children, provide their details on a separate sheet attached to the form.

- Specify the agreement start date which must be a date in the future. Take note that the agreement should adhere to the guidelines for qualifying children.

- Both parties must sign the form, confirming that the information provided is accurate to the best of their knowledge.

- Once all sections are complete, review the information for accuracy. Save your changes, download the completed form, and print or share it as necessary.

Complete your NZ IR102 form online today and ensure your child support agreements are accurately registered.

A foreign tax identification number is not the same as a Social Security Number (SSN). While an SSN is specifically for U.S. citizens and residents for tax and identification purposes, a foreign tax identification number is used by other countries to tax their residents. Understanding these distinctions is critical for effective tax compliance, especially when dealing with international matters like NZ IR102.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.