Loading

Get Uw Extension Sample Letter For Creditors

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UW Extension Sample Letter For Creditors online

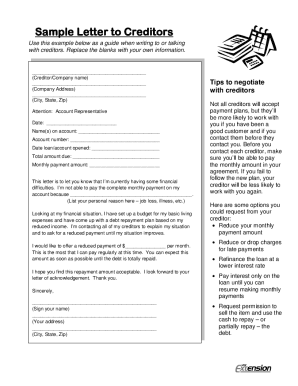

Filling out the UW Extension Sample Letter For Creditors is an essential step for individuals experiencing financial difficulties. This guide provides clear, step-by-step instructions to help users complete the letter accurately and effectively.

Follow the steps to complete your Sample Letter For Creditors online.

- Press the ‘Get Form’ button to access the letter template and open it in an editor.

- Begin by entering the creditor or company name in the first blank space. Ensure that you are correctly spelling the name of the creditor you are addressing.

- In the following blank, input the company address, including street name and number, ensuring accuracy for effective communication.

- Next, provide the city, state, and zip code of the creditor's address in the appropriate spaces.

- Direct your letter to the attention of the account representative by including 'Attention: Account Representative' after the address.

- Insert the current date in the designated area to ensure the letter reflects accurate timing.

- In the ‘Name(s) on account’ section, write the name(s) under which the account is held, ensuring it matches with the creditor’s records.

- Follow with your account number, which is critical for the creditor to identify your account swiftly.

- Provide the date the loan or account was opened to furnish context regarding your financial history.

- Mention the total amount due on your account, which is necessary for negotiating payment terms.

- Enter the amount of the monthly payment that you typically make, as this will assist in the negotiation process.

- In the next section, clearly explain the reason for your financial difficulties by filling in the blank provided. This personal touch can aid in your request for consideration.

- Outline your current financial situation and briefly describe the budget you have developed or the repayment plan you can propose.

- Specify the reduced payment you are offering, making it clear that this is the maximum amount you can pay until your situation improves.

- Conclude the letter with a polite acknowledgment of your repayment proposal and request a letter of acknowledgment from the creditor.

- Sign your name in the designated area to personalize the letter and maintain formality.

- Include your address in the section provided, followed by your city, state, and zip code for communication purposes.

- After completing the letter, save your changes, and consider downloading or printing the document for your records.

- Share the completed letter with your creditors through the appropriate channels.

Complete and send your documents online today to take control of your financial situation.

I respectfully request that you forgive my alleged debt, as my condition precludes any employment, and my current and future income does not support any debt repayment. Please respond to my request in writing to the address below at your earliest convenience. Thank you in advance for your understanding of my situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.