Get Mi Form 1019 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

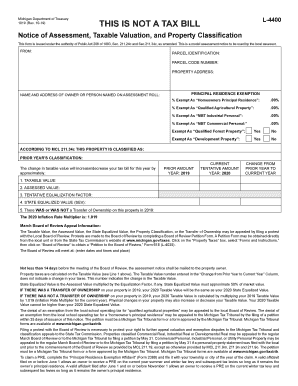

Tips on how to fill out, edit and sign MI Form 1019 online

How to fill out and sign MI Form 1019 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, the majority of Americans prefer to manage their own tax filings and additionally to fill out forms online.

The US Legal Forms online platform facilitates the process of submitting the MI Form 1019 swiftly and effortlessly.

Ensure that you have correctly completed and submitted the MI Form 1019 on time. Check for any relevant deadlines. Providing incorrect information on your tax documents may lead to serious penalties and complications with your annual tax return. Always use reliable templates from US Legal Forms!

- Open the PDF blank in the editor.

- Observe the designated fillable fields. This is where you enter your information.

- Select the option to choose if you see the checkboxes.

- Explore the Text tool and other effective features to manually tailor the MI Form 1019.

- Review all the information prior to signing.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Authenticate your web template online and specify the particular date.

- Press Done to proceed.

- Download or forward the document to the recipient.

How to modify Get MI Form 1019 2019: tailor forms online

Utilize the convenience of the multi-functional online editor while filling out your Get MI Form 1019 2019. Take advantage of the variety of tools to swiftly complete the blanks and supply the required information without delay.

Preparing documents can be time-consuming and costly unless you have pre-made fillable forms and finish them digitally. The optimal strategy for handling the Get MI Form 1019 2019 is to employ our expert and feature-rich online editing tools. We offer you all the necessary instruments for quick form completion and allow you to make any modifications to your templates, customizing them to fit any requirements. Additionally, you can provide feedback on the revisions and leave annotations for other participants.

Here’s what you can accomplish with your Get MI Form 1019 2019 in our editor:

Managing Get MI Form 1019 2019 in our powerful online editor is the fastest and most efficient method to organize, submit, and distribute your documents as you desire from anywhere. The tool operates from the cloud, allowing you to access it from any location on any internet-enabled device. All templates you create or modify are securely stored in the cloud, so you can always retrieve them when needed and be confident that they are not lost. Stop squandering time on manual document filling and eradicate paper; do everything online with minimal effort.

- Fill in the blanks using Text, Cross, Check, Initials, Date, and Sign instruments.

- Emphasize important details with a chosen color or underline them.

- Hide sensitive information using the Blackout feature or simply delete them.

- Include images to illustrate your Get MI Form 1019 2019.

- Substitute the original text with one that meets your preferences.

- Add notes or sticky remarks to notify others about the changes.

- Create additional fillable fields and assign them to specific individuals.

- Secure the document with watermarks, include dates, and bates numbers.

- Distribute the documents in various methods and save them on your device or the cloud in multiple formats after completing your edits.

Get form

Related links form

The 1098 tax form is a document used to report mortgage interest and other related expenses to the IRS. While it is not directly related to the MI Form 1019, understanding the 1098 can help property owners realize the mortgage-related deductions they may qualify for. This knowledge can be beneficial when planning finances around property taxes.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.