Loading

Get Ut Ustc Tc-938 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-938 online

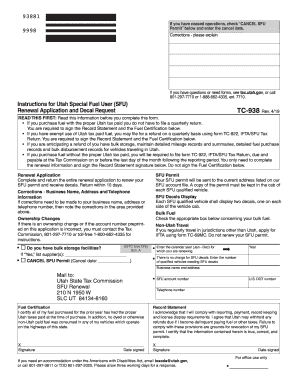

Filling out the UT USTC TC-938 form is an essential step for individuals and businesses using special fuel in Utah. This guide will provide you with clear instructions on completing the form accurately and efficiently.

Follow the steps to complete the UT USTC TC-938 form online.

- Press the ‘Get Form’ button to obtain the UT USTC TC-938 form and open it in your online editor.

- Enter the calendar year for which you are renewing the special fuel user permit in the designated field.

- Provide your business name, address, and telephone number in the appropriate sections. If corrections are needed, include them in the corrections area.

- If applicable, indicate whether you have bulk storage facilities by checking the appropriate box.

- Specify the number of qualified vehicles needing SFU decals in the designated field.

- If you have ceased operations, check the ‘CANCEL SFU Permit’ box and specify the cancellation date.

- Sign the Record Statement and the Fuel Certification below the respective sections to confirm compliance with regulations.

- Once all sections are completed, save your changes. You can then download, print, or share the completed form as needed.

Ready to complete your documentation? Fill out the UT USTC TC-938 online today.

Obtaining a Utah state tax ID number is essential for businesses operating in the state. You can apply for this number directly through the USTC's online portal, which provides a straightforward application process. If you need assistance navigating this, consider using USLegalForms to ensure accurate completion and submission, particularly in reference to UT USTC TC-938.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.