Loading

Get Ut Ustc Tc-922 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-922 online

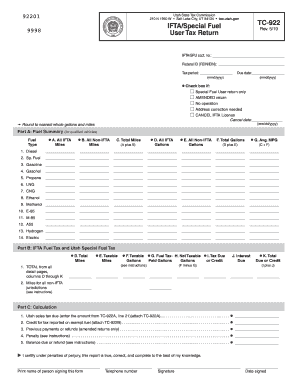

Filling out the UT USTC TC-922 online is an essential task for those who need to report fuel usage for IFTA or special fuel permits. This guide will provide a comprehensive step-by-step approach to complete the form correctly, ensuring all necessary information is submitted with accuracy.

Follow the steps to successfully submit your UT USTC TC-922 online.

- Click ‘Get Form’ button to obtain the TC-922 form and open it in your preferred online editing tool.

- Fill in your company name and address starting below the designated line on the form.

- Enter your Federal ID (FEIN/EIN) and specify the tax period, including the due date in the format mmddyyyy.

- Check the boxes that apply to your situation: if this is a special fuel user return only, an amended return, if there was no operation, or if an address correction is needed.

- In Part A, provide a summary of fuel utilized for qualified vehicles. Input total miles for both IFTA and Non-IFTA vehicles, breaking them down by fuel type.

- Calculate the average miles per gallon (MPG) by dividing total miles by the total gallons for each fuel type listed.

- In Part B, list total miles from all detail pages and calculate the taxable gallons and tax due based on specific guidelines provided.

- Complete Part C calculation by entering any credits, previous payments, and penalties as applicable.

- Certify that the information provided is accurate by signing the form, including your printed name, telephone number, and date signed.

- Once done, save changes, and download or print the completed form for your records or submission.

Complete your UT USTC TC-922 form online today to ensure timely and accurate report submission.

Related links form

You can check your IFTA application status by contacting your state’s IFTA office or visiting their website. Many jurisdictions offer online tools for tracking your application. For additional support, the UT USTC TC-922 can guide you in the steps necessary to check your application status effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.