Loading

Get Tx 06-168 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 06-168 online

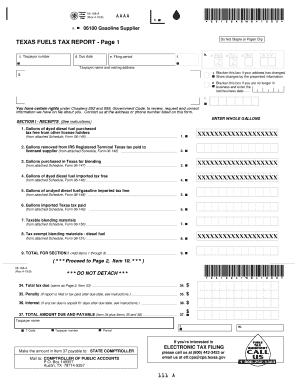

The TX 06-168 is the Texas fuels tax report form used by various fuel suppliers and distributors to report their fuel activities. Filling out this form correctly is crucial for compliance with state tax regulations.

Follow the steps to complete the TX 06-168 online successfully.

- Click ‘Get Form’ button to obtain the TX 06-168 and open it in your online editor.

- Begin by entering your taxpayer information in the designated fields, including your taxpayer number and mailing address. Use the provided boxes to indicate if your address has changed or if you are no longer in business.

- Proceed to Section I, where you will report your fuel receipts. Fill in the appropriate quantities for dyed diesel fuel purchased, gallons removed from IRS registered terminals, and any applicable tax-free imports, based on the corresponding attached schedules.

- Advance to Section II, focusing on disbursements. Document blended gallons sold, tax-exempt sales, and gallons removed from terminals. Ensure that you gather data from attached schedules corresponding to each entry.

- Review Section III for tax calculation. Enter your calculated total tax based on net taxable gallons and any applicable allowances and penalties. Ensure accuracy to avoid late penalties.

- Finally, double-check all entered information for accuracy. Save your changes, download a copy of the completed form, and prepare to print or share it as needed.

Complete your TX 06-168 online today to ensure compliance and timely submission.

Related links form

Filling out a Texas title registration form involves entering your vehicle's details, your name, and your address. Make sure to include all necessary documentation that supports the title, especially in line with TX 06-168 requirements. For a seamless experience, check out uslegalforms for guidance and ready-to-use forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.