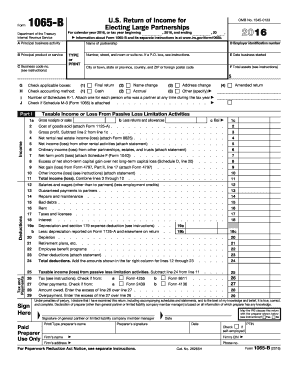

Get Irs 1065-b 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1065-B online

How to fill out and sign IRS 1065-B online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If the taxation period commenced unexpectedly or perhaps you simply overlooked it, it could potentially lead to issues for you. IRS 1065-B is not the most straightforward form, but there is no need for alarm in any situation.

Utilizing our robust service, you will grasp the proper method to complete IRS 1065-B during times of significant time constraints. All you have to do is adhere to these simple guidelines:

With our comprehensive digital solution and its beneficial tools, completing IRS 1065-B turns into a more efficient process. Don’t hesitate to use it and allocate more time to your interests instead of paperwork.

- Access the document using our sophisticated PDF editor.

- Input the necessary details in IRS 1065-B, utilizing fillable sections.

- Incorporate images, marks, checkboxes, and text fields, if desired.

- Repeating data will be automatically populated after the initial entry.

- If you encounter any challenges, activate the Wizard Tool. You will receive helpful advice for a smoother completion.

- Remember to include the application date.

- Create your distinctive e-signature once and place it in all required areas.

- Review the information you have entered. Amend errors if necessary.

- Click on Done to finish editing and choose your preferred delivery method. You can utilize virtual fax, USPS, or email.

- You may also download the document for later printing or upload it to cloud storage services like Dropbox, OneDrive, etc.

How to Modify Get IRS 1065-B 2016: Personalize Forms Online

Benefit from the simplicity of the versatile online editor while completing your Get IRS 1065-B 2016. Utilize the range of features to swiftly fill in the gaps and supply the necessary information in no time.

Preparing documents is tedious and costly unless you have ready-made editable templates to complete electronically. The best approach to handle the Get IRS 1065-B 2016 is to employ our expert and multifunctional online editing tools. We offer you all the vital resources for quick document completion and enable you to modify your templates according to any requirements. Additionally, you can annotate the changes and leave comments for other participants.

Here’s what you are able to accomplish with your Get IRS 1065-B 2016 in our editor:

Managing the Get IRS 1065-B 2016 in our robust online editor is the quickest and most efficient method to organize, submit, and share your documentation as required from anywhere. The tool operates from the cloud, enabling you to access it from any location on any internet-enabled device. All templates you create or prepare are safely stored in the cloud, ensuring you can always retrieve them as needed without the risk of losing them. Stop squandering time on manual document completion and reduce paper use; do everything online with minimal effort.

- Fill in the gaps using Text, Cross, Check, Initials, Date, and Sign options.

- Emphasize important elements with a preferred color or underline them.

- Hide confidential details with the Blackout feature or simply delete them.

- Upload images to illustrate your Get IRS 1065-B 2016.

- Substitute the original text with one that aligns with your specifications.

- Leave remarks or sticky notes for communicating updates with others.

- Add extra fillable sections and assign them to particular individuals.

- Secure the template with watermarks, include dates, and bates numbers.

- Distribute the documents in multiple ways and save them on your device or in the cloud in various formats once you finish editing.

Get form

Related links form

Yes, if your LLC has multiple members, it is required to file form 1065. This requirement is crucial for proper reporting of income and deductions to the IRS, particularly under IRS 1065-B guidelines. Single-member LLCs typically do not need to file this form, but they should confirm their status. You can visit US Legal Forms for additional information and helpful filing tools.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.