Loading

Get Or W2 File Specifications 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR W2 File Specifications online

Filing the OR W2 File Specifications is an essential process for employers and payroll service providers in Oregon. This guide will provide you with clear and detailed steps to complete the form correctly and efficiently.

Follow the steps to complete the OR W2 File Specifications online.

- Click ‘Get Form’ button to obtain the form and open it in your online document editor.

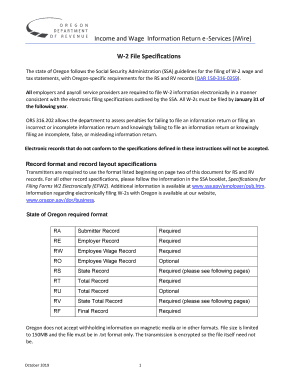

- Review the document layout, starting with the RA Submitter Record. Ensure you fill in your submitter details according to the specifications provided, including mandatory fields.

- Proceed to the RE Employer Record section. Enter the required employer details, ensuring all fields are filled as per the guidelines, paying particular attention to the appropriate formats.

- Complete the RW Employee Wage Record as this section includes crucial information about each employee's wages. Ensure accuracy, as this data is vital for tax reporting.

- If applicable, add any additional RW Employee Wage Records, labeled as RO, ensuring that they meet the optional submission requirements.

- Fill out the RS State Record, which requires specific state-related information. This record is essential for Oregon's tax requirements, including the statewide transit tax.

- Next, complete the RT Total Record and include the required summary information of all records above.

- If you have additional totals, enter details in the RU Total Record, making sure they align with the previous records.

- Your submission must include the RV State Total Record to summarize the total amounts recorded for state wages and withholding.

- Lastly, finish with the RF Final Record to signify the completion of your submission. Ensure that all data is accurately represented.

- Once all sections are completed, save your changes. You can then download, print, or share the completed form.

Complete your OR W2 File Specifications online to ensure compliance with Oregon regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A W2 form requires your personal identification information, your employer's details, and the breakdown of wages earned and taxes withheld throughout the year. All of this information is crucial for accurate tax filings and compliance with the law. By adhering to the OR W2 File Specifications, you can effectively meet these requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.