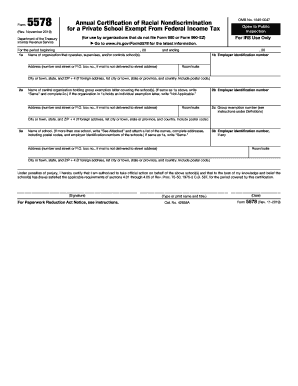

Get Irs 5578 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 5578 online

How to fill out and sign IRS 5578 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If individuals aren’t linked to document administration and legal processes, completing IRS forms will be rather tiring.

We fully understand the importance of accurately concluding documents.

Using our platform will make proficiently completing IRS 5578 a possibility. We will ensure everything for your ease and straightforward work.

- Click the button Get Form to access it and begin editing.

- Complete all necessary fields in your document using our user-friendly PDF editor. Activate the Wizard Tool to make the process even easier.

- Verify the accuracy of the entered information.

- Add the date of submission for IRS 5578. Utilize the Sign Tool to generate a unique signature for the document's validation.

- Conclude modifications by clicking on Done.

- Transmit this file to the IRS in the most convenient manner for you: via email, digital fax, or postal service.

- You can print it out on paper if a hard copy is needed and download or save it to your preferred cloud storage.

How to Alter Get IRS 5578 2019: Personalize Forms Online

Select a dependable document editing choice you can count on. Adjust, finish, and authenticate Get IRS 5578 2019 securely online.

Frequently, altering documents, such as Get IRS 5578 2019, can pose difficulties, particularly if you obtained them online or through email but lack access to specialized software. Certainly, you can employ some alternative methods to circumvent this issue, but you risk producing a document that fails to fulfill submission standards. Utilizing a printer and scanner isn’t a viable option either due to its time- and resource-intensive nature.

We offer a more straightforward and efficient method of altering forms. A vast selection of document templates that are simple to modify and authenticate, and make fillable for others. Our service goes far beyond just a collection of templates. One of the greatest benefits of using our offerings is that you can edit Get IRS 5578 2019 directly on our platform.

As it's a web-based service, it spares you from needing to download any software. Furthermore, not all organizational policies permit you to install it on your work laptop. Here's the most effective way to conveniently and securely finalize your forms with our service.

Bid farewell to paper and other inefficient methods for completing your Get IRS 5578 2019 or other documents. Use our tool instead, which combines one of the most extensive libraries of ready-to-edit forms and comprehensive document editing services. It's user-friendly and secure, and can save you significant time! Don’t just take our word for it, give it a try yourself!

- Click the Get Form > you’ll be taken to our editor instantly.

- Once opened, you can initiate the editing procedure.

- Choose checkmark, circle, line, arrow, and cross among other features to annotate your document.

- Select the date field to insert a specific date into your file.

- Incorporate text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields option on the right to insert fillable fields.

- Click Sign from the top toolbar to create and add your legally-binding signature.

- Press DONE to save, print, and share or obtain the output.

When writing a check to the IRS, you should address it to 'United States Treasury.' Ensure that you include your name, address, Social Security number, and the tax year to prevent any processing delays. If you are ensuring payment related to your application for IRS 5578, keep a copy for your records. US Legal Forms can help clarify payment procedures and provide templates for your needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.