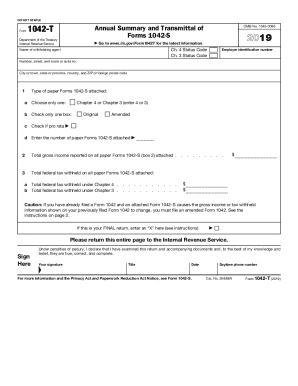

Get Irs 1042-t 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1042-T online

How to fill out and sign IRS 1042-T online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If the taxation phase commenced unexpectedly or perhaps you simply overlooked it, it might lead to complications for you. IRS 1042-T is not the most straightforward one, but there is no need for alarm in any event.

Utilizing our handy solution will demonstrate how to complete IRS 1042-T even in cases of severe time constraints. All you have to do is adhere to these simple instructions:

With this comprehensive digital solution and its valuable tools, submitting IRS 1042-T becomes much easier. Don’t hesitate to test it and spend more time on your interests rather than on preparing paperwork.

Access the document in our robust PDF editor.

Input all the necessary information in IRS 1042-T, utilizing the fillable fields.

Add images, check marks, tick boxes, and text boxes, as necessary.

Repeated information will be automatically filled in after the initial entry.

If you encounter challenges, use the Wizard Tool. You will receive guidance for easier submission.

Remember to include the date of submission.

Create your personalized signature once and place it in the required areas.

Review the information you have entered. Correct any errors if necessary.

Click on Done to complete editing and choose how you will transmit it. You will find options to use online fax, USPS, or email.

You can also download the document to print later or upload it to cloud storage.

How to Alter Get IRS 1042-T 2019: Tailor Forms Online

Eliminate the chaos from your documentation routine. Uncover the easiest method to locate, adjust, and submit a Get IRS 1042-T 2019.

The procedure for preparing Get IRS 1042-T 2019 demands precision and concentration, particularly from those who are not well acquainted with this kind of task. It is crucial to obtain an appropriate template and populate it with the accurate information. With the right solution for managing paperwork, you can have all the tools at your disposal.

It is straightforward to streamline your editing process without mastering new abilities. Locate the right example of Get IRS 1042-T 2019 and complete it immediately without needing to switch between your browser tabs. Uncover additional tools to personalize your Get IRS 1042-T 2019 form in the editing mode.

While on the Get IRS 1042-T 2019 page, click on the Get form button to commence editing. Input your details directly into the form, as all the necessary tools are available right here. The sample is pre-structured, so the effort required from the user is minimal. Utilize the interactive fillable fields in the editor to effortlessly finalize your documentation. Simply select the form and enter the editor mode instantly. Fill out the interactive field, and your document is ready.

Often, a minor mistake can spoil the entire form when someone fills it out manually. Say goodbye to inaccuracies in your paperwork. Discover the templates you require in moments and complete them electronically using a smart editing solution.

- Add more text around the document if necessary. Utilize the Text and Text Box tools to insert text into a separate box.

- Incorporate pre-designed visual elements like Circle, Cross, and Check using the respective tools.

- If necessary, capture or upload images to the document with the Image tool.

- If you wish to draw something in the document, employ the Line, Arrow, and Draw tools.

- Try the Highlight, Erase, and Blackout tools to adjust the text in the document.

- If you need to add comments to specific sections of the document, click the Sticky tool and position a note where desired.

Get form

Related links form

The key difference between a W-2 and a 1042-S lies in their intended audiences. A W-2 is provided to U.S. employees detailing wages and taxes withheld. Conversely, a 1042-S is for foreign individuals or entities, reporting income and withholding on payments made to them. Understanding these distinctions is vital for proper tax reporting.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.