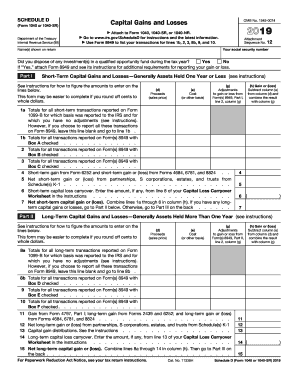

Get Irs 1040 - Schedule D 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1040 - Schedule D online

How to fill out and sign IRS 1040 - Schedule D online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the taxation period commenced unexpectedly or you simply overlooked it, it could likely lead to issues for you. IRS 1040 - Schedule D is not the simplest one, but there is no cause for concern in any event.

Utilizing our ultimate platform, you will discover the correct method to complete IRS 1040 - Schedule D in cases of significant time constraints. You just need to adhere to these straightforward instructions:

With our comprehensive digital solution and its professional tools, completing IRS 1040 - Schedule D becomes more straightforward. Don’t hesitate to utilize it and enjoy more time on hobbies and interests rather than on paperwork preparation.

- Open the document with our robust PDF editor.

- Complete the necessary information in IRS 1040 - Schedule D, utilizing the fillable fields.

- Add images, crosses, checkboxes, and text boxes, if required.

- Repeated information will be incorporated automatically after the initial entry.

- If you encounter any issues, utilize the Wizard Tool. You will find helpful suggestions for easier completion.

- Remember to include the application date.

- Create your unique signature once and place it in the required areas.

- Review the information you have entered. Correct any mistakes if necessary.

- Click Done to complete modifications and choose how you will submit it. You will have the option to use virtual fax, USPS, or email.

- You can download the file to print it later or upload it to cloud storage such as Dropbox, OneDrive, etc.

How to modify IRS 1040 - Schedule D 2019: personalize documents online

Ditch the conventional paper method of filling out IRS 1040 - Schedule D 2019. Have the document finished and verified in no time with our exceptional online editor.

Are you obligated to alter and finalize IRS 1040 - Schedule D 2019? With a powerful editor like ours, you can accomplish this task in just minutes without the hassle of printing and scanning forms repeatedly. We provide entirely customizable and user-friendly document templates that will serve as a starting point and assist you in completing the necessary document layout online.

All documents, by default, include fillable sections you can utilize once you open the file. However, if you wish to refine the existing content of the file or introduce new elements, you can select from a variety of editing and commenting tools. Emphasize, redact, and annotate the document; add checkmarks, lines, text boxes, images, and notes. Furthermore, you can quickly certify the document with a legally-binding signature. The finalized document can be shared with others, stored, sent to external applications, or converted into any popular format.

You’ll never make an incorrect choice using our online tool to execute IRS 1040 - Schedule D 2019 because it’s:

Don’t waste time completing your IRS 1040 - Schedule D 2019 in a outdated manner - with pen and paper. Utilize our comprehensive tool instead. It offers you an extensive range of editing features, built-in eSignature options, and convenience. What makes it exceptional is the collaborative features - you can work on documents with anyone, establish a well-organized document approval workflow from start to finish, and much more. Try our online tool and get the best value for your investment!

- Simple to set up and navigate, even for those who haven’t filled out documents electronically before.

- Sufficiently robust to accommodate various editing requirements and document types.

- Safe and protected, ensuring your editing experience is secure every time.

- Accessible across multiple devices, making it easy to complete the form from anywhere.

- Capable of generating documents based on pre-drafted templates.

- Compatible with a variety of file formats: PDF, DOC, DOCX, PPT, and JPEG, etc.

Get form

Related links form

The new 1040 form for seniors is the 1040SR, which was introduced to cater specifically to taxpayers aged 65 and older. This form offers a simplified layout and larger text, making it easier for seniors to navigate their tax information. Utilizing 1040SR can help seniors take advantage of deductions and credits they may qualify for without feeling overwhelmed.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.