Get Wi Form 1952 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI Form 1952 online

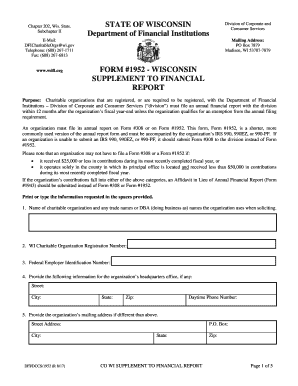

This guide provides clear and supportive instructions for completing the WI Form 1952 online. Designed for charitable organizations, this form is essential for reporting financial information to the Department of Financial Institutions in Wisconsin.

Follow the steps to complete the WI Form 1952 online effectively.

- Press the ‘Get Form’ button to access the form and open it in your online document editor.

- Enter the name of your charitable organization along with any trade names or 'doing business as' names you utilize in solicitations. Ensure this is accurate to maintain compliance.

- Provide your Wisconsin Charitable Organization Registration Number, which is critical for identification purposes.

- Input your Federal Employer Identification Number, necessary for tax identification.

- Fill in the address of your organization’s headquarters, including street, city, state, and zip code, as well as the daytime phone number.

- If you have a different mailing address, provide that as well by filling in the street address, city, state, and zip code.

- If applicable, provide details for any Wisconsin offices the organization has, including their addresses and phone numbers.

- List the details of the person(s) responsible for the organization’s financial records, including their name, address, city, state, zip, and phone number.

- Include information for the person(s) in charge of contributions, making sure to provide their complete contact details.

- Specify the individual responsible for financial inquiries, including their relevant contact information.

- Describe the charitable purpose or purposes for which contributions will be used; attach a document if necessary.

- Indicate if your organization used a professional fund-raiser or fund-raising counsel and provide their details if applicable.

- Answer questions about any changes to previously submitted information and provide a detailed explanation if necessary.

- Respond to questions about authorization by other authorities to solicit contributions and any previous denials or suspensions of such authority.

- Provide financial details for the organization's accounting period, noting the start and end dates, and the accounting method used.

- Enter the financial information including contributions, other revenues, total revenue, and expenses, ensuring all figures are accurate.

- Check off the required attachments, including IRS Form #990, 990EZ, or 990-PF, and ensure compliance with all attachment requirements.

- Certification by signing the document to confirm that the information is correct, provided by the president or authorized officer and the chief fiscal officer.

- Finalize the form by saving your changes. You can also download, print, or share the completed form as needed.

Complete your WI Form 1952 online today to ensure compliance and maintain your organization's good standing.

Get form

In Wisconsin, a nonprofit must have at least three board members who are not related by blood or marriage. This structure ensures a diverse range of perspectives and fosters accountability in your organization. The board will be responsible for overseeing operations and complying with legal requirements, including filing documents like the WI Form 1952. Working with uslegalforms can provide resources to help you establish an effective board.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.