Loading

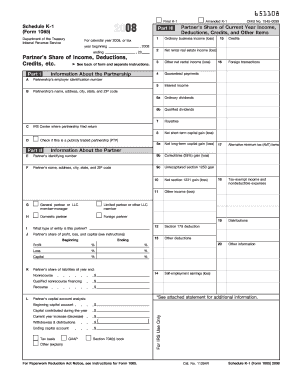

Get Irs 1065 - Schedule K-1 2008

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1065 - Schedule K-1 online

Filling out the IRS 1065 - Schedule K-1 can seem complex, but this guide will provide you with clear, step-by-step instructions to simplify the process. Whether you are new to tax forms or have some experience, this guide aims to support you in completing the form accurately online.

Follow the steps to complete your Schedule K-1 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the partnership's name, address, city, state, and ZIP code in Part I. This information identifies the entity to which you are connected.

- For the Partner's share of profit, loss, and capital in Part II, ensure you accurately complete the fields for Beginning and Ending amounts. This represents your ownership interest in the partnership.

- Review any alternative minimum tax items and tax-exempt income and nondeductible expenses to assess their relevance to your general tax situation.

Complete your IRS 1065 - Schedule K-1 online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, you must include your K-1 when filing IRS Form 1065. It provides essential information regarding your earnings and tax obligations as a partner. Ensuring you file K-1 correctly helps maintain compliance with IRS regulations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.