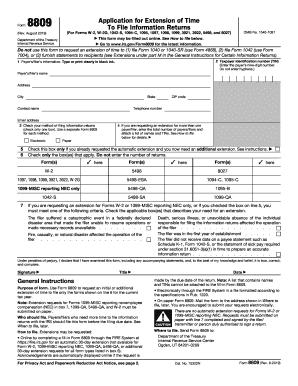

Get Irs 8809 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8809 online

How to fill out and sign IRS 8809 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When you aren't linked to document management and legal procedures, completing IRS documents can be quite challenging.

We recognize the importance of accurately finalizing documents.

Using our powerful solution will facilitate professional completion of IRS 8809, ensuring everything is tailored for your comfort and security.

- Click the button Get Form to access it and begin editing.

- Fill in all required fields in your document using our advanced PDF editor. Activate the Wizard Tool to make the process even simpler.

- Verify the accuracy of the entered information.

- Include the date of completing IRS 8809. Use the Sign Tool to create a unique signature for the document's validation.

- Finish editing by clicking on Done.

- Send this document directly to the IRS in the most convenient way for you: via email, virtual fax, or postal service.

- You can print it out on paper if a hard copy is necessary and download or save it to your desired cloud storage.

How to modify Get IRS 8809 2019: personalize forms online

Locate the appropriate Get IRS 8809 2019 template and alter it instantly. Optimize your documentation with an intelligent form editing solution for online paperwork.

Your everyday document workflow can be enhanced when you have everything you require in a single location. For instance, you can search for, obtain, and alter Get IRS 8809 2019 within one browser tab. If you need a particular Get IRS 8809 2019, it is straightforward to locate it using the intelligent search engine and access it immediately. There is no need to download it or seek a third-party editor to adjust it and include your information. All the resources for effective work come in one consolidated solution.

This editing solution allows you to personalize, complete, and sign your Get IRS 8809 2019 form instantaneously. When you find a suitable template, click on it to enter the editing mode. After you open the form in the editor, you have all the vital tools at your disposal. It is simple to populate the designated fields and delete them if necessary using a user-friendly yet versatile toolbar. Implement all the changes instantly, and sign the form without leaving the tab by merely clicking the signature field. Following that, you can send or print your document if needed.

Make additional custom adjustments with the provided tools.

Uncover new possibilities for efficient and seamless paperwork. Locate the Get IRS 8809 2019 you require in minutes and complete it in the same tab. Eliminate the chaos from your documentation once and for all with the assistance of online forms.

- Annotate your document using the Sticky note feature by placing a note at any location within the document.

- Incorporate necessary visual elements, if required, with the Circle, Check, or Cross tools.

- Alter or input text wherever in the document using Texts and Text box features. Insert content using the Initials or Date tool.

- Revise the template text utilizing the Highlight and Blackout, or Erase tools.

- Add custom visual elements using the Arrow and Line, or Draw tools.

Get form

Related links form

Generally, the IRS cannot collect on a debt that is 10 years old or older. However, various factors, such as payment agreements or bankruptcy, can affect this timeline. Utilizing IRS 8809 can help you navigate your filing obligations during this statute of limitations period.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.