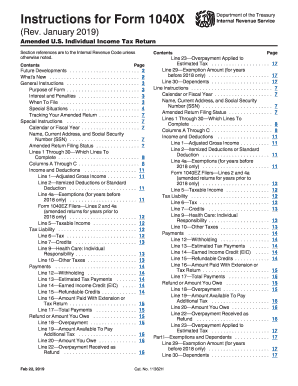

Get Irs Instructions 1040x 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS Instructions 1040X online

Filling out the IRS Instructions 1040X online can be straightforward with the right guidance. This form is utilized to amend your previously filed U.S. Individual Income Tax Return. It is essential to follow the step-by-step instructions to ensure accuracy and compliance.

Follow the steps to accurately complete the IRS Instructions 1040X online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name, current address, and Social Security Number (SSN) on the top of Form 1040X. Make sure that these details match the original return.

- Indicate your filing status by checking the appropriate box for your amended return.

- Complete Part I by listing any dependents that apply-related to exemptions and credits.

- In Part II, if desired, check the box to contribute to the Presidential Election Campaign Fund.

- For Columns A, B, and C on lines 1 through 30, enter the information as directed in the instructions provided for each line. Be sure to accurately reflect any changes compared to the original return.

- Review all completed information for accuracy. Ensure all additional schedules needed are attached according to the instructions.

- Save your changes, download the filled form, and print it for filing or sharing as necessary.

Start your amended return process by completing the IRS Instructions 1040X online today!

Get form

Related links form

You should not file a 1040X if you are making changes that do not affect your income tax liability, such as updates for the filing of a return not required by law. Additionally, if the amendment results in an amount owed, consider if filing is necessary or if you should resolve the issues first. Always refer to IRS Instructions 1040X for guidance to ensure you are making the right decision.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.