Get Irs 56 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 56 online

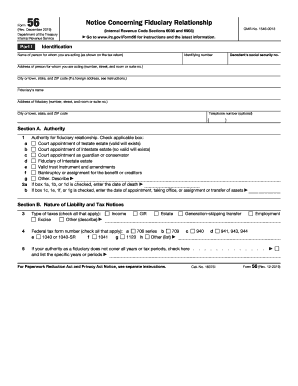

Filling out the IRS 56, also known as the notice concerning fiduciary relationship, is an important process for anyone acting on behalf of another individual regarding tax responsibilities. This guide provides clear, step-by-step instructions to ensure that you can complete the form accurately and efficiently online.

Follow the steps to fill out the IRS 56 with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, identify the person for whom you are acting. Fill in their name, social security number, and identifying number accurately. Provide their complete address as well.

- Below the identification section, enter the fiduciary's name and address as required. Optional: include a telephone number.

- In Section A, specify the authority for the fiduciary relationship by checking the applicable box(es) that match your situation, and provide the relevant dates as instructed.

- In Section B, indicate the type of taxes that apply by checking all relevant boxes. Further, check the corresponding federal tax form numbers for reporting.

- If your fiduciary authority is limited to specific years or tax periods, indicate this by checking the designated box and listing those periods.

- In Part II, specify any revocation or termination of prior fiduciary notices by checking the appropriate box and providing reasons if applicable.

- If any substitutions for fiduciaries are being made, check the relevant box and provide the names and addresses of the new fiduciaries.

- In Part III, provide details regarding any court or administrative proceedings related to the fiduciary relationship, including dates and addresses.

- Finally, review the entire document, sign where indicated, and include the date. Ensure accuracy to fulfill perjury declarations.

- Once completed, you can save changes, download, print, or share the form as needed.

Prepare your documents and complete the IRS 56 online for efficient tax management.

Failing to file IRS Form 56 may lead to confusion regarding your status as a fiduciary. This could result in the IRS not recognizing your authority to manage tax matters, leading to potential penalties. Properly filing the form is crucial for avoiding complications. Always consider reaching out to resources like US Legal Forms to help navigate these requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.