Get Pr Form 483.20 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR Form 483.20 online

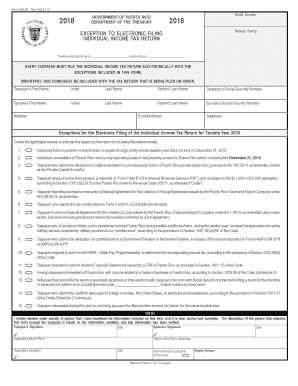

Filling out the PR Form 483.20 online can seem daunting, but this guide will provide a clear, step-by-step approach to help you navigate the process effectively. This form is essential for individual income tax returns in Puerto Rico, particularly for those who qualify for exceptions to electronic filing.

Follow the steps to complete your PR Form 483.20 online.

- Select the ‘Get Form’ button to retrieve the PR Form 483.20 and open it in your document editor.

- Begin by entering the taxpayer's first name, initial, last name, and second last name in the respective fields.

- Input the taxpayer's Social Security number accurately in the designated field.

- Fill in the spouse's first name, initial, last name, and second last name, if applicable.

- Enter the spouse's Social Security number in the required section.

- Provide the address, email address, and telephone number of the taxpayer to ensure accurate communication.

- Indicate the applicable exception(s) for not filing electronically by checking the corresponding box(es). Make sure to review the list carefully to select all that apply.

- Complete the oath section by signing and dating the form. Ensure the specialist's name and signature are filled in, if necessary.

- After reviewing the form for accuracy, save any changes made and choose to download, print, or share the form as needed.

Start filling out your PR Form 483.20 online today for a streamlined tax filing experience.

The 1040 PR tax form is a version of the IRS 1040 designed for residents of Puerto Rico to report their income. This form allows residents to include unique income sources specific to Puerto Rico and account for local tax laws. Completing the 1040 PR accurately is essential for compliance and avoiding penalties. Utilizing the PR Form 483.20 can aid residents in understanding their obligations and streamline their filing experience.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.