Loading

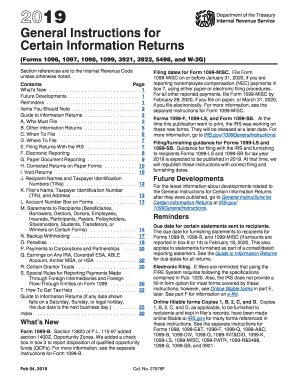

Get Irs General Instructions For Certain Information Returns 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS General Instructions for Certain Information Returns online

This guide provides a comprehensive overview of how to navigate and complete the IRS General Instructions for Certain Information Returns online. It aims to assist users, regardless of their experience level, in efficiently managing their filing responsibilities.

Follow the steps to effectively fill out the form.

- Press the ‘Get Form’ button to access the necessary form and open it in your online editor.

- Review the contents of the instructions to understand the new developments and reminders that may affect your filing.

- Identify which form you need to file (e.g., Form 1096, 1099, etc.) based on your reporting requirements.

- Fill out each section accurately. Ensure that the names and taxpayer identification numbers (TINs) match IRS records to avoid future discrepancies.

- If applicable, indicate any amounts subject to backup withholding and report them properly as instructed.

- Once the form is completed, save your changes. You can also download, print, or share the completed form as needed.

Complete your information returns online for efficiency and accuracy.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, Staples typically carries a range of IRS tax forms. However, availability may vary by location, so it is wise to call ahead. For authoritative resources and the IRS General Instructions for Certain Information Returns, visiting the IRS website remains your safest bet.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.