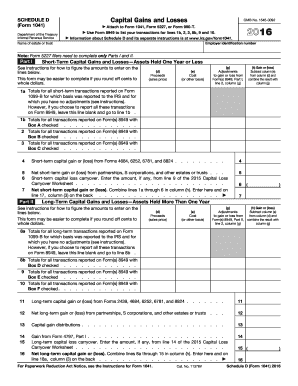

Get IRS 1041 - Schedule D 2016

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Filers online

How to fill out and sign Computation online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax season began unexpectedly or maybe you just misssed it, it could probably create problems for you. IRS 1041 - Schedule D is not the easiest one, but you have no reason for panic in any case.

Utilizing our ultimate platform you will learn how to fill IRS 1041 - Schedule D in situations of critical time deficit. The only thing you need is to follow these simple instructions:

-

Open the document using our advanced PDF editor.

-

Fill in the information needed in IRS 1041 - Schedule D, making use of fillable fields.

-

Insert graphics, crosses, check and text boxes, if it is supposed.

-

Repeating details will be filled automatically after the first input.

-

In case of misunderstandings, switch on the Wizard Tool. You will get some tips for easier completion.

-

Never forget to include the date of filing.

-

Draw your unique e-signature once and place it in all the required lines.

-

Check the details you have included. Correct mistakes if necessary.

-

Click Done to finish modifying and select how you will deliver it. There is the opportunity to use digital fax, USPS or email.

-

You are able to download the record to print it later or upload it to cloud storage like Dropbox, OneDrive, etc.

With our powerful digital solution and its advantageous instruments, filling out IRS 1041 - Schedule D becomes more practical. Do not wait to work with it and have more time on hobbies rather than on preparing documents.

How to edit Worksheet: customize forms online

Make the best use of our comprehensive online document editor while completing your paperwork. Fill out the Worksheet, indicate the most significant details, and easily make any other necessary modifications to its content.

Preparing paperwork electronically is not only time-saving but also comes with a possibility to modify the template in accordance with your demands. If you’re about to manage the Worksheet, consider completing it with our robust online editing solutions. Whether you make an error or enter the requested details into the wrong area, you can easily make adjustments to the form without the need to restart it from the beginning as during manual fill-out. Apart from that, you can point out the essential data in your document by highlighting specific pieces of content with colors, underlining them, or circling them.

Adhere to these simple and quick actions to fill out and adjust your Worksheet online:

- Open the file in the editor.

- Type in the necessary information in the blank fields using Text, Check, and Cross tools.

- Follow the form navigation to avoid missing any mandatory fields in the template.

- Circle some of the crucial details and add a URL to it if necessary.

- Use the Highlight or Line tools to emphasize the most significant facts.

- Choose colors and thickness for these lines to make your sample look professional.

- Erase or blackout the data you don’t want to be visible to other people.

- Replace pieces of content that contain mistakes and type in text that you need.

- End up modifcations with the Done key after you make sure everything is correct in the form.

Our robust online solutions are the most effective way to fill out and customize Worksheet according to your requirements. Use it to prepare personal or business paperwork from anyplace. Open it in a browser, make any changes in your documents, and get back to them at any moment in the future - they all will be securely stored in the cloud.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing unrecaptured

Experience the best way to prepare your 11376v online in a matter of minutes by following our step-by-step instructions. Use easy-to-submit templates made by professionals for everyday people.

OMB FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to IRS 1041 - Schedule D

- lossesassets

- instr

- form1041

- wrksht

- unrecaptured

- 11376v

- OMB

- Distributions

- filers

- III

- taxable

- Computation

- worksheet

- taxed

- partnerships

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.