Get Ak Form 560 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 560 online

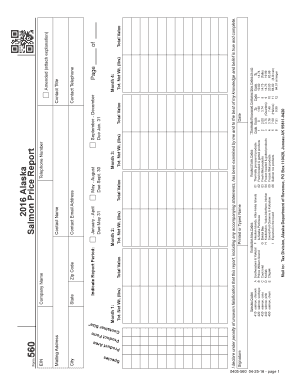

Filling out the AK Form 560 online is a straightforward process that enables individuals and organizations to report their salmon pricing accurately. This guide will provide step-by-step instructions to help you complete this form with confidence.

Follow the steps to successfully complete the AK Form 560 online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering your company name in the designated section. Ensure that the name matches what is registered with the appropriate authorities.

- Indicate the report period by selecting the appropriate dates for your submission, such as January to April, May to August, or September to December.

- For each month of the reporting period, enter the total net weight in pounds for the salmon you are reporting. Make sure to divide the weights accordingly for each month.

- Next, provide the total value of the salmon reported for each month. Carefully calculate this value to ensure accuracy.

- If you are submitting an amended report, check the appropriate box and attach an explanation as required.

- Fill in your contact information, including your name, title, email address, and telephone number, ensuring it is accurate for follow-up questions.

- Select the applicable species codes from the provided list to classify the salmon you are reporting.

- Identify the product form codes relevant to your submissions, selecting from options such as thermally processed products or fresh fillet products.

- Specify the container size codes based on the quantity of product reported, referencing the guidelines provided in the form.

- Once all fields are complete, review the form for any errors or omissions.

- Finally, save your changes and then download, print, or share the form as necessary.

Complete your AK Form 560 online today for accurate and efficient documentation.

Related links form

You can get an extension from the IRS by filing Form 4868, which allows you to extend your filing deadline by six months. Make sure to submit this form electronically or by mail to ensure your request is processed on time. Keep in mind that this extension does not extend your payment deadline, so be proactive in managing any taxes owed. For guidance on tax forms and more, explore US Legal Forms, which offers detailed resources related to the AK Form 560.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.