Loading

Get Ak Form 531 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 531 online

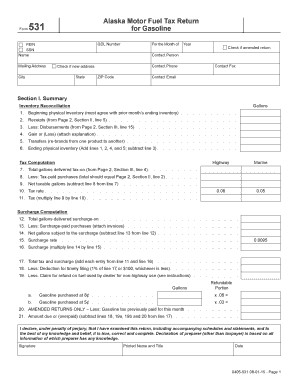

The AK Form 531 is essential for reporting gasoline transactions and calculating motor fuel taxes in Alaska. This guide provides a clear, step-by-step approach to help users fill out the form accurately and efficiently, even if they have little prior experience with such documents.

Follow the steps to complete the AK Form 531 online.

- Press the ‘Get Form’ button to access the AK Form 531 and open it in the editor. This will allow you to start filling out the required fields online.

- Enter your QDL number, FEIN or SSN, and name in the designated fields. Ensure all information is accurate and aligns with your records.

- Indicate the month and year for which you are filing the return. If this is an amended return, check the appropriate box.

- Provide details of the contact person including their mailing address, contact phone number, and email. If there is a new address, check the corresponding box.

- Move to Section I for the Summary. Accurately report your beginning physical inventory, receipts, disbursements, gains or losses, and transfers. Use the respective lines for calculations and ensure totals are accurate.

- In the Tax Computation section, report the total gallons delivered tax-on, less tax-paid purchases to determine net taxable gallons. Input the tax rate and subsequently calculate the total tax.

- Proceed to the Surcharge Computation section to detail the gallons delivered surcharge-on and compute the total tax and surcharge. Ensure you complete the applicable lines for accurate calculations.

- Complete the final lines indicating deductions and claims for refund as applicable. Summarize the amount due or overpaid at the bottom of the form.

- Review all sections for accuracy and completeness, making necessary adjustments before finalizing your form.

- Once satisfied, save your changes and choose to download, print, or share the completed AK Form 531 as required.

Complete your AK Form 531 online today to ensure timely and accurate filing.

Related links form

To claim the Employee Retention Credit (ERC) on Form 941, you will need to report the eligible wages and calculate the credit amount clearly. Make sure to follow the IRS guidelines closely, as the calculations can be intricate. If you seek further clarity or assistance, consider USLegalForms for relevant documentation and guidance on forms like AK Form 531.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.