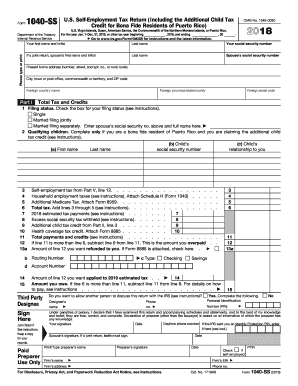

Get Irs 1040-ss 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040-SS online

Filling out the IRS 1040-SS form online can seem overwhelming, but this guide will help simplify the process. The IRS 1040-SS is specifically designed for self-employed individuals who need to report their income and calculate their self-employment tax. Follow the steps below to complete the form with confidence.

Follow the steps to successfully fill out the IRS 1040-SS online.

- Click ‘Get Form’ button to obtain the 1040-SS form and access it in your preferred online document editor.

- Begin by entering your personal information, including your first name, last name, and social security number. If filing jointly, include your partner’s details as well.

- Provide your present home address, including the city, state, and ZIP code. If applicable, include your foreign country name and postal code.

- In Part I, select your filing status by checking the appropriate box: single, married filing jointly, or married filing separately while entering your spouse’s information as required.

- If you are claiming the additional child tax credit and are a bona fide resident of Puerto Rico, list your qualifying children by filling in their names, social security numbers, and their relationship to you.

- Input details for total tax and credits. Ensure you calculate self-employment tax from Part V, line 12, along with any household employment taxes or additional Medicare tax as applicable.

- Fill in the amounts for estimated tax payments, excess social security tax withheld, and any additional child tax credit. Total all payments and credits in the designated field.

- If you have overpaid, specify the amount to be refunded and include your mailing preferences for the refund.

- Proceed to sign the form, declaring that the information provided is true to the best of your knowledge. If filing jointly, ensure both signatures are present.

- After completing the form, review all entries for accuracy. You can save changes, download, print, or share the completed form.

Complete your IRS 1040-SS form online today for a smooth filing experience.

Get form

Related links form

The primary difference between Form 1040 and Form 1040-NR lies in the taxpayer's residency status. Form 1040 is for U.S. citizens and residents, while Form 1040-NR is designated for non-resident aliens. Each form has specific filing requirements and applicable credits or deductions. If you are navigating these differences, platforms like USLegalForms can help guide you in completing the appropriate form, including nuances related to the IRS 1040-SS.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.