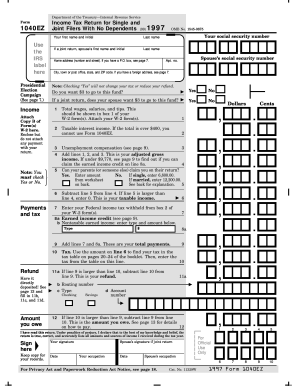

Get 1997 1040 Ez Form 1997

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1997 1040 Ez Form online

Filling out the 1997 1040 Ez Form online can simplify your tax filing process. This guide provides detailed, step-by-step instructions to help you complete the form accurately and efficiently, ensuring you meet all necessary requirements.

Follow the steps to complete the 1997 1040 Ez Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your personal information, including your name, social security number, and home address in the designated fields.

- For line 1, report your total wages, salaries, and tips as shown in box 1 of your W-2 form(s). Ensure to attach Copy B of your W-2 here.

- On line 2, include any unemployment compensation you received. This can be found in your Form 1099-G, if applicable.

- Total the amounts from lines 1, 2, and 3. This amount will represent your adjusted gross income, which is recorded on line 4.

- In line 5, indicate whether your parents or anyone else can claim you as a dependent. Select 'Yes' or 'No'.

- Subtract line 5 from line 4 to determine your taxable income, which you'll write on line 6. If the result is negative, enter 0.

- For line 7, if eligible, claim the earned income credit as instructed. Refer to the specific guidelines provided on page 9 of the form booklet.

- Enter the tax amount on line 10 based on your taxable income found in the tax table on pages 20-24 of the form booklet.

- Calculate your total payments by adding lines 7 and 8a, and record this on line 8a.

- On line 9, enter the total federal income tax withheld from box 2 of your W-2 form(s).

- Determine your refund or amount owed: if line 9 exceeds line 10, subtract line 10 from line 9 for your refund. If line 10 is greater than line 9, subtract line 9 from line 10 for the amount owed.

- Sign and date the form at the bottom, confirming all information provided is accurate to the best of your knowledge.

- After you have filled out the form, you can save your changes, download, print, or share the completed form as required.

Take control of your finances and complete your 1997 1040 Ez Form online today to ensure a smooth filing process.

Get form

Related links form

The 1997 1040 EZ Form was intended for individuals without dependents who had uncomplicated financial situations, such as single filers or married couples with joint income. However, given that the form is no longer in use, taxpayers should now assess their eligibility for the current Form 1040 or its variants. Always consider seeking assistance from resources like US Legal Forms to ensure you file correctly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.