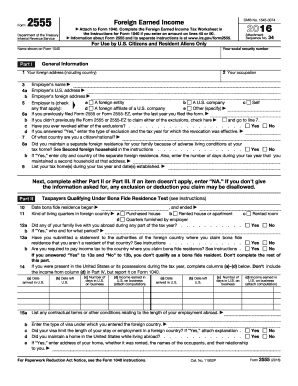

Get Irs 2555 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2555 online

The IRS 2555 form is crucial for U.S. citizens and resident aliens who earn income in foreign countries. This guide offers a comprehensive overview of each section of the form, providing clear step-by-step instructions to facilitate an accurate online completion.

Follow the steps to successfully complete the IRS 2555 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal details such as your social security number and the name shown on Form 1040. You'll need to provide your foreign address and occupation under Part I, General Information.

- In Part I, question 4, indicate the employer's name and addresses, including both U.S. and foreign locations if applicable. Check appropriate boxes regarding your employer's status.

- Continue with questions about previous filings of Form 2555. Specify if you have ever revoked any exclusions and provide details of any foreign residence maintained due to living conditions.

- Proceed to either Part II or Part III, depending on whether you qualify under the bona fide residence test or the physical presence test. Complete the relevant information and note any periods spent in the U.S.

- In Part IV, report all foreign earned income received during the tax year in U.S. dollars. Ensure to convert foreign currencies based on the rates at the time of income receipt.

- If applicable, complete Part V for housing exclusions or deductions. Provide details about qualified housing expenses and calculate any relevant limits.

- Review all entries for accuracy. You have the option to save changes, download, print, or share the completed form as necessary before final submission.

Complete your IRS 2555 form online today to ensure compliance with tax regulations and maximize your eligible deductions.

Get form

The formula for calculating foreign income generally involves determining your total income earned outside the United States and subtracting any exclusions you qualify for using IRS Form 2555. You should consider all wages and self-employment income. To simplify this process, platforms such as USLegalForms provide helpful tools and information for accurate calculations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.