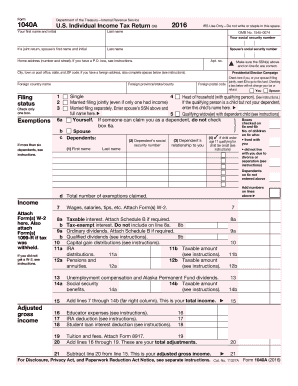

Get Irs 1040-a 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1040-A online

How to fill out and sign IRS 1040-A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If the fiscal period began unexpectedly or you simply overlooked it, it may likely cause issues for you. IRS 1040-A is not the most straightforward form, but you have no reason to be concerned in any instance.

By using our expert service, you will comprehend the optimal way to complete IRS 1040-A even in scenarios of significant time constraints. You just need to adhere to these uncomplicated instructions:

With our robust digital solution and its useful features, submitting IRS 1040-A becomes simpler. Do not hesitate to utilize it and allocate more time to hobbies and passions instead of preparing paperwork.

Access the document in our specialized PDF editor.

Provide the required information in IRS 1040-A, using the fillable fields.

Incorporate images, ticks, checkboxes, and text boxes, if desired.

Repeating fields will be generated automatically after the initial entry.

If you encounter any difficulties, activate the Wizard Tool. You will receive helpful hints for smoother completion.

Always remember to add the filing date.

Create your distinctive signature once and place it in the necessary spots.

Review the information you have entered. Correct errors if necessary.

Click Done to finalize alterations and choose how you will submit it. You can use digital fax, USPS, or email.

You may also download the file to print it later or upload it to cloud storage.

How to modify Get IRS 1040-A 2016: personalize forms online

Streamline your document preparation process and tailor it to your requirements within moments. Complete and endorse Get IRS 1040-A 2016 with a robust yet user-friendly online editor.

Document preparation is frequently challenging, particularly when you only do it occasionally. It requires you to meticulously follow all protocols and accurately fill all fields with complete and precise information. However, it is common to find that you need to modify the form or add additional fields to complete. If you want to enhance Get IRS 1040-A 2016 prior to submission, the simplest method is by utilizing our powerful yet easy-to-navigate online editing tools.

This comprehensive PDF editing tool enables you to quickly and efficiently complete legal documents from any device with an internet connection, perform basic modifications to the form, and add more fillable fields. The service permits you to designate a specific area for each type of data, such as Name, Signature, Currency, and SSN etc. You can make them mandatory or conditional and choose who should fill out each field by assigning them to a specified recipient.

Our editor is a versatile multi-functional online solution that can assist you in quickly and easily modifying Get IRS 1040-A 2016 and other templates according to your requirements. Decrease document preparation and submission time and enhance your paperwork appearance without any trouble.

- Access the required template from the catalog.

- Complete the sections with Text and place Check and Cross tools in the tickboxes.

- Use the right-side panel to modify the template with new fillable areas.

- Choose the fields based on the type of data you want to collect.

- Make these fields mandatory, optional, and conditional and adjust their order.

- Assign each area to a specific individual with the Add Signer tool.

- Verify if you've made all the necessary modifications and click Done.

Get form

Related links form

Requesting a copy of your IRS 1040-A can be done through the IRS website, using Form 4506. You can also call the IRS and ask for copies to be mailed to you. This process typically takes a bit of time, so be sure to plan ahead if you need your form quickly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.