Loading

Get Ak Form 355 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 355 online

Filling out the AK Form 355 is an essential process for assigning tax credit certificates in Alaska. This guide will provide you with clear, step-by-step instructions on how to complete the form efficiently and accurately online.

Follow the steps to successfully complete the AK Form 355 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

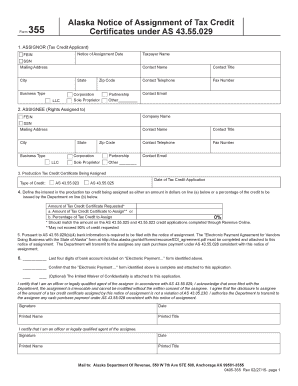

- Begin by filling out the 'Assignor' section. Enter the notice of assignment date, FEIN, taxpayer name, and contact information. Be sure to select the correct business type from the options provided.

- In the 'Assignee' section, provide the necessary details for the party to whom the rights are being assigned. Include the company name, FEIN, SSN, mailing address, and contact details, ensuring accuracy.

- Fill in the section related to the production tax credit certificate being assigned. Indicate the type of credit being assigned and the date of the tax credit application.

- Complete the next section by defining the interest in the production tax credit. Specify the amount or percentage of the credit being assigned. The total must correspond with the previously submitted credit application.

- Incorporate the required bank information as mandated by AS 43.55.029(b)(4). Attach the 'Electronic Payment Agreement for Vendors Doing Business with the State of Alaska' as an enclosed document.

- Confirm the last four digits of the bank account associated with the payment agreement and verify that the necessary forms are attached. Optionally, attach the limited waiver of confidentiality if required.

- Complete the certification sections for both the assignor and assignee by providing signatures, dates, printed names, and titles.

- Lastly, review all entries for clarity and accuracy before saving, downloading, or printing the completed form to submit it to the Alaska Department of Revenue.

Complete your AK Form 355 online today to ensure a smooth assignment process.

Related links form

In Massachusetts, partnerships that generate income must file a partnership return. This applies to general partnerships, limited partnerships, and limited liability partnerships that have a presence in the state. Utilizing the AK Form 355 allows partnerships to report income accurately and meet compliance requirements. US Legal Forms provides tools to simplify this filing process for you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.