Loading

Get Ca Ftb 3552 Pc 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3552 PC online

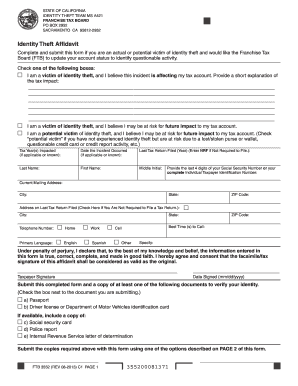

This guide provides clear and supportive instructions for users on how to complete the California Franchise Tax Board Identity Theft Affidavit, also known as the CA FTB 3552 PC. This step-by-step approach is designed to help you navigate the online form efficiently.

Follow the steps to successfully complete the CA FTB 3552 PC online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Select one of the three boxes to indicate your status as a victim of identity theft. Provide a brief explanation if you believe the incident is impacting your tax account.

- Enter the tax year(s) that were impacted by the identity theft if applicable or known.

- Input the date the incident occurred, if applicable or known.

- Fill in the year of your last tax return filed. If not required to file, enter 'NRF'.

- Provide your last name, first name, and middle initial.

- Enter the last four digits of your Social Security Number or your complete Individual Taxpayer Identification Number.

- Complete your current mailing address, including city, state, and ZIP code.

- If applicable, fill out the address on your last tax return filed, marking the box if you are not required to file a tax return.

- Provide your telephone number and indicate whether it is a home, work, or cell number.

- Select your primary language from the available options.

- Indicate the best times to call, specifying if necessary.

- Sign and date the form, affirming that the information is true and made in good faith.

- Check the box for at least one document you are submitting to verify your identity and provide a copy of that document with your form.

- Review all provided information, then save changes, download, print, or share the completed form as needed.

Complete the CA FTB 3552 PC online to ensure your identity theft report is processed efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To fix IRS identity theft, begin by contacting the IRS and reporting the fraud. You will often need to fill out necessary forms and provide supporting documentation to prove your identity. Utilizing tools from platforms like USLegalForms, including the CA FTB 3552 PC form, can help streamline the process and assist you in rectifying your records efficiently.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.