Loading

Get Irs 1040 Schedule 8812 Instructions 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 Schedule 8812 Instructions online

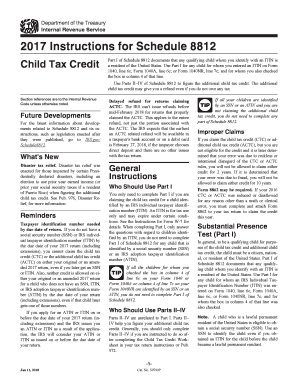

The IRS 1040 Schedule 8812 is a crucial document for taxpayers claiming the child tax credit and the additional child tax credit. This guide provides a step-by-step approach to completing this form online, ensuring that you understand each component and can effectively navigate the process.

Follow the steps to fill out the IRS 1040 Schedule 8812 Instructions online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete Part I if you are claiming the child tax credit for a child identified by an ITIN. Answer all questions regarding qualifying children with ITINs only.

- For each dependent listed, determine if they meet the substantial presence test and complete Line A for the first dependent you identified with an ITIN.

- If applying for more than four children, check the box following Line D and continue on a new Schedule 8812.

- Proceed to Parts II–IV if you meet the criteria and have dependents qualifying for the additional child tax credit.

- Use the Earned Income Chart to determine the amount to enter on line 4a, referencing any applicable disaster relief measures.

- Fill out lines 4b, 10, and any additional necessary lines as required for calculations specific to your situation.

- Review all entries to ensure accuracy before finalizing the form.

- Once complete, users can save changes, download, print, or share the form as necessary.

Complete your IRS documents online for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Filing Schedule 8812 involves completing the form accurately and attaching it to your IRS Form 1040. Begin by gathering necessary documents such as your child’s information and your income. Using the detailed IRS 1040 Schedule 8812 Instructions will help streamline your filing process, ensuring you follow each necessary step.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.