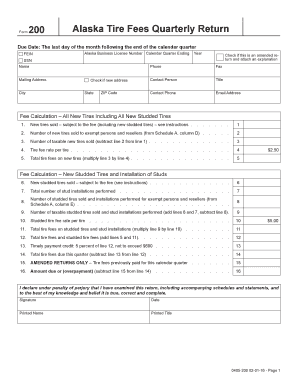

Get Ak Form 200 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign AK Form 200 online

How to fill out and sign AK Form 200 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the tax duration started unexpectedly or perhaps you just overlooked it, it might create issues for you.

AK Form 200 is not the most straightforward one, but there is no need to panic in any event.

Utilizing our comprehensive digital service and its valuable tools, submitting AK Form 200 becomes more efficient. Don't hesitate to engage with it and enjoy more time on hobbies rather than file preparation.

- Access the document in our sophisticated PDF editor.

- Complete the required information in AK Form 200, utilizing fillable spaces.

- Incorporate images, marks, checkboxes, and text fields, if necessary.

- Repeated information will be automatically populated after the initial entry.

- If you encounter any challenges, utilize the Wizard Tool. You'll receive some advice for simpler submission.

- Remember to add the application date.

- Create your distinctive signature once and insert it into the designated areas.

- Review the information you have entered. Amend errors if necessary.

- Click Done to finalize modifications and choose how you will send it. You can opt for online fax, USPS, or email.

- You can download the document for future printing or upload it to cloud storage.

How to amend Get AK Form 200 2016: personalize forms online

Put the right document modification features at your fingertips. Execute Get AK Form 200 2016 with our reliable service that merges editing and electronic signature functionality.

If you aspire to complete and sign Get AK Form 200 2016 online effortlessly, then our online cloud-based solution is the way to go. We provide a rich template-based library of ready-to-use documents you can modify and finalize online. Furthermore, you don’t need to print the form or use third-party services to make it fillable. All the essential tools will be readily accessible once you open the file in the editor.

Let’s explore our online editing features and their primary attributes. The editor possesses a user-friendly interface, so it won't take much time to learn how to use it. We’ll examine three main sections that allow you to:

In addition to the features mentioned above, you can secure your file with a password, add a watermark, convert the document to the desired format, and much more.

Our editor makes completing and certifying the Get AK Form 200 2016 a breeze. It enables you to perform virtually everything related to document handling. Moreover, we consistently ensure that your experience working with documents is safeguarded and adheres to the essential regulatory standards. All these elements make using our tool even more enjoyable.

Obtain Get AK Form 200 2016, make the required edits and adjustments, and download it in the preferred file format. Give it a try today!

- Alter and annotate the template

- The top toolbar includes tools to help you emphasize and obscure text, without images and visual elements (lines, arrows, checkmarks, etc.), sign, initialize, date the form, and more.

- Arrange your documents

- Utilize the toolbar on the left if you wish to re-organize the form and/or remove pages.

- Make them shareable

- If you want to make the template fillable for others and distribute it, you can use the tools on the right to insert various fillable fields, signatures, dates, text boxes, etc.

Related links form

Creating a trust in Alaska involves several steps, starting with defining the trust's purpose and beneficiaries. You will then need to draft a trust document, followed by funding the trust with assets. Utilizing resources like uslegalforms can streamline this process, ensuring you comply with Alaska's legal requirements, and guiding you through forms like the AK Form 200 if needed.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.