Loading

Get Irs 1040 - Schedule Eic 2009

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule EIC online

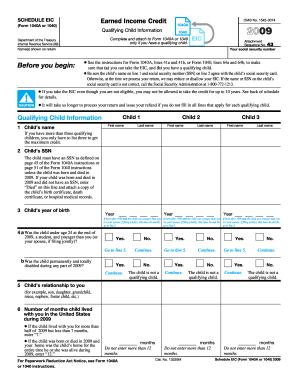

Filling out the IRS 1040 - Schedule EIC online can seem daunting, but this guide will help you understand the necessary steps to complete the form accurately. The Schedule EIC is crucial for those claiming the earned income credit, specifically when there is a qualifying child involved.

Follow the steps to successfully fill out the IRS 1040 - Schedule EIC.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your name and social security number at the top of the form. This information must match what is on your tax return.

- Fill out the 'Qualifying Child Information' section for each qualifying child. You can list up to three children. Ensure the names and social security numbers correspond with the children's social security cards.

- For each child, indicate their year of birth and answer whether they were a student or permanently disabled during the year 2009. You may skip these questions if the child was born after 1990 and is younger than you.

- Complete the 'Child’s relationship to you' section by entering your relationship to each child listed. This may include terms such as son, daughter, or grandchild.

- Enter the number of months each child lived with you in the United States during 2009. If applicable, follow the specific guidance for children who were born or died within the year.

- Review all entered information for accuracy. It is essential that the details provided are correct to avoid processing delays or disallowance of the earned income credit.

- Once you have filled out all necessary fields and verified your information, save your changes. You can then choose to download, print, or share the completed form as needed.

Complete your IRS 1040 - Schedule EIC online today to ensure you receive any eligible credits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The EITC calculator is an online tool provided by the IRS and various tax platforms to estimate your potential Earned Income Tax Credit. By inputting relevant financial details, you can get a preliminary idea of your eligible credit. Utilize such a calculator before submitting your IRS 1040 - Schedule EIC for a clearer picture of your benefits.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.