Loading

Get Irs 1040 - Schedule Eic 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule EIC online

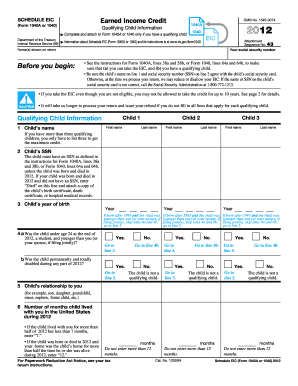

Filling out the IRS 1040 - Schedule EIC online is essential for individuals seeking to claim the earned income credit for qualifying children. This guide provides clear, step-by-step instructions to help users navigate each section of the form easily.

Follow the steps to fill out the IRS 1040 - Schedule EIC effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by ensuring that you meet the eligibility criteria for the earned income credit (EIC). Refer to the instructions related to Form 1040A or Form 1040 to confirm your qualification and the presence of a qualifying child.

- In the 'Qualifying Child Information' section, start by entering the name of your first qualifying child in the designated field, ensuring accuracy against their social security card.

- Enter the child's social security number (SSN) in the specified field. If the child does not have an SSN due to being born and dying in the year, mark “Died” and attach the appropriate documentation.

- Document the year of birth for each qualifying child in the provided field to confirm eligibility.

- Indicate whether the qualifying child was under age 24 and a student by marking ‘Yes’ or ‘No’ in the relevant subsection. Follow up with the next question based on your response.

- State whether the qualifying child was permanently and totally disabled during any part of the year. If so, mark ‘Yes’, otherwise mark ‘No’.

- Specify the child’s relationship to you (e.g., son, daughter, etc.) in the indicated field.

- Indicate the number of months the child lived with you in the United States during the year. Follow instructions carefully if the child lived with you for less than 7 months.

- Once all sections are filled out, review the information for accuracy. Save your changes, and then utilize options to download, print, or share the completed form as needed.

Complete your IRS 1040 - Schedule EIC online today to ensure you unlock your earned income credit!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, you can claim the Earned Income Credit (EIC) on your taxes if you meet the specific income limits and qualifying child criteria. To do this accurately, use IRS 1040 - Schedule EIC to assist in your filing. By claiming EIC, you could reduce your tax burden significantly and possibly receive a larger refund.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.