Get Irs 1040 - Schedule E 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule E online

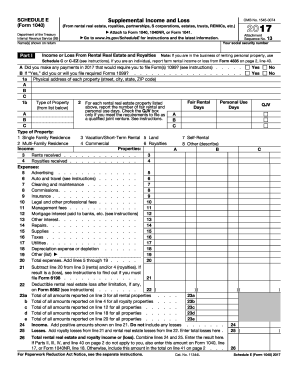

Filling out the IRS 1040 - Schedule E form is essential for reporting supplemental income and loss from various sources. This guide provides a clear, step-by-step approach to help users complete the form accurately online.

Follow the steps to fill out Schedule E efficiently.

- Click 'Get Form' button to obtain the Schedule E form and open it in your preferred online editor.

- Enter your name and social security number as shown on your tax return. This identification is crucial for processing your form correctly.

- In Part I, indicate whether you made any payments that require filing Form 1099 by checking 'Yes' or 'No'.

- List the physical address of each rental property in the provided spaces, specifying the type of property, such as single-family residence or multi-family residence.

- Report the income received from rents and royalties in the appropriate fields. Ensure accuracy in the amounts entered.

- Detail your expenses, including advertising, cleaning and maintenance, legal fees, and mortgage interest paid. Add all expenses together.

- Subtract the total expenses from your rental income to determine your net income or loss.

- Complete the sections for Partnerships, S Corporations, and other income or loss as required in the following parts of the form.

- At the end of the form, review all entries for accuracy and completeness to avoid errors.

- Once satisfied with your entries, save your changes, download the completed form, print it for your records, or share it as necessary.

Start filling out your IRS 1040 - Schedule E online today for a streamlined tax filing experience.

Get form

Related links form

Yes, IRS 1040 - Schedule E can reduce your taxable income by allowing you to deduct certain expenses related to your rental properties. Deductions can include mortgage interest, property taxes, and repairs, which, when subtracted from your rental income, can lead to a lower taxable amount. Understanding how to properly utilize Schedule E will help you maximize these benefits. For more assistance, consider using tools that can clarify these deductions as you file.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.